The financial end of the world in economic apocalypse is here. A funny thing happened on the road to recovery: Trump’s chief strategist admitted his view of the Trumpian future looks like the Great Depression. Even the world’s largest bank just said global financial default is the preferable way out and most likely way out of the Great Recession that began in 2007/2008. That’s the new optimism. You don’t get better than all of that for an exhilarating view of the imminent future. As Maya MacGuineas, the leader of the Committee for a Responsible Federal Budget, also assessed the situation,

The financial end of the world in economic apocalypse is here. A funny thing happened on the road to recovery: Trump’s chief strategist admitted his view of the Trumpian future looks like the Great Depression. Even the world’s largest bank just said global financial default is the preferable way out and most likely way out of the Great Recession that began in 2007/2008. That’s the new optimism. You don’t get better than all of that for an exhilarating view of the imminent future. As Maya MacGuineas, the leader of the Committee for a Responsible Federal Budget, also assessed the situation,

“President-elect Trump is going to be inheriting the worst fiscal situation of any president… other than President Truman … as judged by the debt relative to the economy.” (The Washington Post)

Trump’s solution for that problem requires that we enormously increase that debt and hope to power through. That puts him in a no-win scenario unless he can jack the economy up faster than he jacks up the debt; but we are already seeing the likelihood of that fall apart before the plan begins, as I’ll explain. That Trump’s plan will increase the debt is not just something his critics are claiming but is also something his own chief strategist, Stephen Bannon, admits to from the outset of this journey into oblivion:

“With negative interest rates throughout the world, it’s the greatest opportunity to rebuild everything,” Bannon said. “Shipyards, ironworks, get them all jacked up. We’re just going to throw it up against the wall and see if it sticks. It will be as exciting as the 1930s, greater than the Reagan revolution.” (The Washington Post)

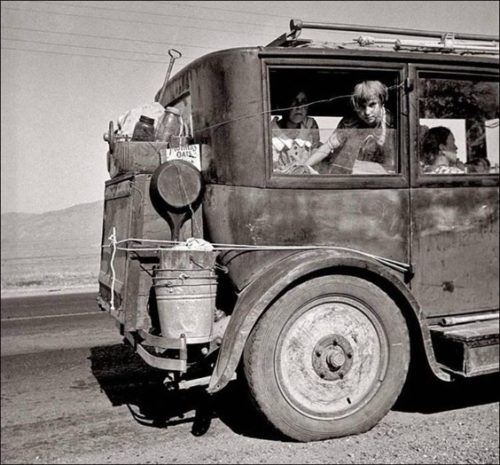

“Throw it up against the wall and see if it sticks” sounds like a description of a last-ditch effort if I ever heard one. It’s certainly not the usual new administration optimism. “As exciting as the 1930s?” Yikes. The plan is for something as exciting as the greatest economic collapse the modern world has known … until now. And clearly the plan here is only made possible by interest so low that it is in some places negative. So, pack the bags on the jalopy because 2017 is going to be a heck of a ride.

I don’t fault Bannon or Trump for this because I have said all along that we will never avoid the economic collapse that our mountains of debt and our greedy banks have already assured. We can only push it off but make it greater by doing so. I may have jumped the gun a little with my prediction of the Epocalypse at the start of 2016, but a year later we have some of the most unlikely places admitting we are going there, so I didn’t jump it by much. (Wait until you read what Deutsche Bank has to say.)

While I’m not surprised at all by where we are headed, I am surprised at Bannon’s stark admission that Trump’s plan will take us on a journey as “exciting” as the Great Depression of the 1930’s — not exactly everyone’s favorite period in history to relate to if one is trying to build belief in a recovery plan.

He’s right, of course, but I’m surprised to find someone who is trying to stir excitement for his plan comparing it to the worst time the oldest people alive can remember — a time they hoped they would never revisit. I suppose I shouldn’t be because that is where we are, and Bannon’s nature is to say things as they are. You just don’t usually hear such stark expression from the president’s chief strategists. Again, such is the nature of our time. (And I’d rather hear things as they are than pretend otherwise.)

While I’m sure Bannon wasn’t expressing dumbfounded joy about experiencing another decade like the Great Depression, he was saying that Trump’s debt-heavy plan is much like Roosevelt’s WPA. That’s where we are — in an economy that has stalled to the point that it will take a WPA-sized plan to move it any further ahead. That thought, too, is not exactly hopeful because we also had a global war to help gas the engines of the economy out of the 30s, and that has been looking more likely throughout 2016, too.

I agreed at the start of the Obama administration that we should take out debt to accelerate the economy and position the nation for a more vibrant future because then we would, at least, be handing the next generation some genuinely valuable merchandise in exchange for all the debt we created … so long as we focused on projects that really needed to be done anyway. While I’m not so sure about the proverbial crumbling bridges that have provided the argument for taking on more debt for a decade or more, there are plenty of needed projects in the form of antiquated sewer systems that are far from capable of handling today’s capacity, major city water systems that still use wooden pipes, etc.

I suggested then, “Do it now, while the price tag is lower than it may be in the future and while the cost of finance is dropping.” But that was then, and it’s too late now for reasons I’ll lay out here. It’s an opportunity that was lost due to a non-visionary, do-nothing-in-the-face-of-catastrophe, obstructionist congress.

I’m for using debt to get some things going when the prices are down and jobs are in short supply and then paying it back as things start picking up. I’m for using debt responsibly like a tool, not like a replacement for the oxygen we breath … but when has the US done that in the last half a century? We have been profligate, lazy debt abusers, paying for nothing as we go, living off the generosity of a future that has no say in the matter.

My thoughts at the start of the Great Recession: there are always projects that need to be done, why not do them when labor is cheaper and easier to find and when the cost of credit is extremely low. That is just common-sense wisdom as a way of creating jobs and getting things done that are government’s responsibility and that have been put off for too long anyway.

However, I have been saying for the last four years that we squandered that opportunity for the past seven years as the Republicans obstructed such attempts and as the Obama administration, frankly, did very little to push such ideas through. Obama had no vision and put more effort into changing bathroom laws. Trump does have vision, but Obama already spent the debt capacity the US had for doing such bold ideas. Now that the Obama administration has doubled the national debt to $20 trillion, the debt relative to the total size of the economy (when measured in GDP), as MacGuineas says, is the highest its been since the end of WWII. Hitting that point is a game-changer in terms of what you can now do with debt.

We’re at 100% of the total economy owed in debt! From what we’ve seen in other nations that are bordering on collapse, going above that mark gets seriously precarious, while even hitting that level suffocates the economy. We’re at a debt load that is only survived at all because interest rates are the lowest they have been in the history of the world. (Literally. No nation has ever given money away to the degree that nations around the world have been doing over the last few years.)

The current budget deficit is already running well over half a trillion dollars a year, and that’s while making interest payments that are almost nil. What will the deficit be if rates rise to historically normal levels, even if we don’t finance Trump’s plan? No one knows exactly what the maximum debt ceiling for any nation is, but I believe we are now seeing a clear sign that we have hit that level, and “throw it up against the wall and see if it sticks” doesn’t sound like a well-thought-out plan that justifies another trillion in debt over time. (Many say it will really come to five trillion.)

Summing up the Trumped-up tax benefits

On the surface of the Trump plan, what’s not to like if your in business or are a stock investor?

- massively increased infrastructure spending … without paying for it

- increased military spending … without paying for it

- repatriation of corporate profits at low-to-no taxes

- corporate tax cuts

- personal income-tax cuts

- capital gains tax cuts

How can you not throw the world’s biggest party when you’re doing all of that? So, let me start by saying I think it will stimulate the economy … and the stock market, too. It has already begun to do so. It is such a massive shift into finally applying fiscal policy toward growth, instead of just relying on monetary policy, that it forcibly revises the timing of my predicted Epocalypse … but probably not by much.

It adds up to a form of government quantitative easing as massive as everything the Federal Reserve has done and more — entirely new ammo just as all the central banks are, as David Stockman keeps saying, “out of dry powder.” The government will issue enough bonds to pay for all that spending and all those tax cuts (which they hope will make it possible for you to amp up spending, too), and none of us have to ever pay for it!

That’s why Reaganomics stimulated the economy so much. We bought everything and left it to others to pay for it. (We’ve just continued to move that along and greatly increase it under George II and Obama.) Since Trump’s plan will be the biggest pay-for-it-all-later flood of stimulus in the history of the nation, how can it not boost the economy? (Hint. I’ll tell you in a moment.)

The Federal Reserve provided $2.2 trillion of direct quantitative wheezing. Trump is promising double that in new national debt alone. On top of that, the amount of new cash back into the country as a result of repatriation is estimated to be about another trillion. And then there is the money they hope you will spend from your tax savings.

But where will all the money go?

Trump knows where the money the government raises through bond issues will be spent (because he will control the spending), but he only thinks he knows what will happen with all the repatriated corporate cash and the corporate tax savings. Will most of that money go to expand factories and create jobs as Team Trump says? … As Ronald Reagan said? While Goldman Sachs is not trustworthy in the slightest, I think they are right on the money here, and I’ll explain why:

“A significant portion of returning funds will be directed to [stock] buybacks based on the pattern of the tax holiday in 2004,” the team, led by Chief U.S. Equity Strategist David Kostin, write. They estimate that $150 billion (or 20 percent of total buybacks) will be driven by repatriated overseas cash. They predict buybacks 30 percent higher than last year, compared to just 5 percent higher without the repatriation impact.” (Bloomberg)

This is a no-brainer in my view because I choose to learn from history. In the absence of strong markets, corporations for the past couple of years have focused primarily on using their cash to buy back stocks and have used their available cheap credit to do even more buybacks. Corporations have found that their boards and CEOs can make a lot more money a lot faster with less risk by playing the market with company stocks and company cash than actually building anything.

These buybacks don’t make any money for the corporations, so it is not “business;” but they generate a ton of money for the wealthy owners as they milk their corporations dry. Why would they change that plan if more free money is on its way? Why would they spend it, as Trump and his tax maestro’s think they will, on capital investments to build products for which demand has been slowing? (If repatriation and corporate tax cuts were conditional based on companies not doing any buybacks, then maybe it would accomplish something more than jacking the stock market up another time; but I’ve heard no rumor of such conditions being built into the new tax code.)

Some of the money will also be spent on increased dividends to shareholders to keep stock prices rising with enticements because that is also what corporations have been doing in recent history. Those dividends will, in turn, get reinvested in more stock speculation.

And then there will be acquisitions of new companies to make bigger conglomerates, which helps eliminate jobs. All of which does nothing for the general economy; but it’s huge for the stock market. So, there are many reasons to think the stock market could soar again to even greater bubblicious heights.

Infrastructure projects will kick some corporations into capital investment by creating demand, instead of just supply; but, as Goldman indicates, I suspect the recently adopted habits of going for the low-hanging fruit will not end as the most favored way to put the government plans directly into the pockets of the rich.

So, there are LOTS of reasons to think stocks will go up IF the plan is enacted, and that’s why you see people quickly repositioning for that now by moving to stocks like Caterpillar, which are cheap because the company has been doing so poorly, but which should do well if the government starts building lots of infrastructure that requires lots of heavy equipment.

Of course, Trump will have to get all of this through congress. Dem’s should love it, they wanted to boost infrastructure spending when obstructionist Republicans resisted. Now that it’s the Republican plan, most Republicans will approve it, except the diehard deficit hawks; so the Repubs will need a few Dems to join them. Will they join, though? Or will Dems return the Republican’s approach by dishing out their own obstructionism, and will they get the few remaining fiscally conservative Repubs to give them enough strength to obstruct the plan?

That part is anyone’s guess, but my guess would be that most of the plan makes it through because the nation expects action.

Who benefits when Trump’s cards are played?

Corporations are not that excited about the large nominal tax cut because, for most of them, their effective rate is already that low or even lower because of the endless loopholes their lobbyists have worked into the system — dodges for which only those who can afford a battalion of tax accountants and a fleet of attorneys need apply.

If Plan Trump does work, the people who benefit most will be the same people who have prospered off the entire Great Recession so far. As I say at the top of this site, “It’s been a great recession … for a few.” (This is what I warned of about Trump’s economic plan before the election.)

That’s why the stocks that are rising the fastest from the mere thought of the tax cuts are the Wall Street banks that created the Great Recession! If they had known such a populist shift would drive up their stocks, they would have voted for Trump themselves. (Maybe they did and did protest too much only because they knew the populace would vote for anything the banksters pretended to hate, as I also said before the election. After all, remember how Goldman Sachs intentionally counseled its clients to do the opposite of what it was doing with its own money when they created the Great Recession?)

The banksters certainly have nothing to complain about at the moment as rising interest rates lift them out of bank hell, and they are no more likely to be put in jail than their close friend, Crooked Hillary. So, all of this is a bank holiday so far.

While the spending increases will create jobs and may benefit the average person with higher-pay, there is a caveat so big that is already undercutting the longterm success of the infrastructure-spending stimulus program and could even stop it from happening by taking us straight to default as the first step of true recovery.

The self-defeating effects of Trump’s spending spree

There is some certainty in all of this: Massively cutting taxes while hugely increasing spending assures everyone that the government will take on a lot more debt. That means issuing a lot more bonds and other treasury debt instruments. That means interest will rise. In anticipation of that, interest on bonds has already risen at the fastest rate in history (1.5 times faster than the previous record in 1994). And that rapid interest increase is happening at the mere thought of Trump’s program.

The rise in bond interest has also already translated into rising interest on mortgages, which has triggered an increase in mortgage applications as people see the writing on the wall and rush to finish their home purchases before the rates climb higher still. In other words, people are waking up to the fact that the days of low interest are fading fast.

A few more certain conclusions follow from all of that: Rising interest is certain to make Trump’s infrastructure programs harder to accomplish without breaking the government. That undercuts the whole idea laid out by Bannon that the time to buy new infrastructure is now when interest rates are low. The plan has already started a self-defeating loop where the cost of credit is rising rapidly long before any specific projects are even talked about. That is a huge danger sign.

In other words, Trump’s plan appears to be defeating itself long before it even goes to congress. As I’ve been saying for years, such is the plight a nation eventually comes to when it reaches peak debt. You pile the debt forward to the point where you cannot push it any further because funding new expansion with new debt drives up your interest costs beyond what you can keep up with.

The rapid rise of interest, even while the Fed has its target set to the bottom, is a gauge that indicates we are there. All we can do now is spin our tires, trying to push the snow drift any further, or kill our engine.

Bond funds are facing a liquidity crisis. If you simply buy government bonds directly and hold them for their full term, your money is stuck but pretty safe … at least, until the government defaults, by which point all bets of any kind are off anyway. However, bond funds, which most retirement funds invest in, are another story. Since fund managers buy and sell bonds, the value of their existing bonds drops when the government and others start paying higher interest on new bond issues in order to attract buyers. That causes people to rush out of those funds, and the funds face a liquidity crisis, as we are now seeing, leaving them struggling to try to find ways to cash those people out who are fleeing the fund.

I have always questioned whether the bond market bubble would crash first or the stock market bubble. Since Trump’s massive changes are boosting the stock market before they even happen and breaking the bond market, we can pretty well see where the economy is going to crack.

As Zero Hedge notes:

Each time the bond market has crashed in the last few decades, a financial crisis has quickly followed:

The rise in US interest rates is also pushing up the cost for many other nations to finance their national debts because they have to compete for investors. Following a decade of exponential increases in sovereign debt and corporate debt, this rapid rise in interest rates — still in its infancy — is the most dangerous thing that could happen. It has the potential to be massively worse than a stock market crash because it can take down entire nations around the world.

The question that remains is “Are we there yet?” Are we at that point where Trump will not be able to raise funds for his projects without raising the cost of interest on the national debt to a level that means certain default because we cannot raise the debt fast enough to pay for the interest increases that raising the debt causes?

Who knows, but the historically rapid rise in bond interest over the past two weeks could be what “there” looks like when you finally find it — a state where the mere thought of your plans drives up your financing costs faster than you can even talk about the plans, making it impossible to carry them out — a place where debt expansion ends itself.

If that happens, this stock-market rise will be short lived as it builds in anticipation and talk of the plan but the cost of interest to fund the plan turns the plan into an unobtainable mirage before it even launches. That would cause panic in a market that just made huge changes to reposition for the benefits of that plan, and it would leave the market with nowhere to go. Unless the rate of rise in interest slows down as quickly as it began, we will be there before the president-elect takes office.

So, here’s an interesting little side effect: If bond interest keeps rising like it has been, the next raise in the Fed’s interest target becomes irrelevant. Whether the Fed raises its interest target or not, the market is now taking over and raising interest for them — even mortgage interest.

Trump’s program funding needs are so massive — at a time when the nation already has more debt than it could possible afford if it had to pay historically normal, market-determined interest — that the simple thought of that financing need is a force with more power than the strings the Federal Reserve pushes.

In fact, you have to ask, “If the Fed’s target interest rate is still 0.25%, why are they not holding things there right now? Are they unable to do anything to slow the rise?” In the very least, Trump’s plan will force the Fed into more quantitative easing because they will have to soak up all of that government debt and add it to their own balance sheet — just to keep the government debt affordable — but it appears they have already lost the ability to hold rates down or have just given up (as I said I thought they would if Trump won).

It is one thing when the Fed does quantitative easing just to stimulate the economy; it’s quite another when quantitative easing becomes a constant necessity just to keep the national debt affordable. At that final phase of the debt trap, you are caught in a vortex of debt that you cannot accelerate your way out of.

How close is a multi-nation debt default?

Before you think that the Donald is a billionaire so he knows what he is doing, bear in mind that the Donald’s own great expectations for huge projects funded with debt have not always created prosperity … even for him. In fact, those loses were so great that he still uses them to offset 100% of his tax burden (up to the last available returns), and those were simple, small-scale projects compared to rebuilding a nation. He’s had several times when great expectations funded on mountains of debt collapsed.

Dont’ worry about it, though. The Donald has plan for the nation if they throw all of this at the wall and it doesn’t stick, which he has already laid out:

“I’m the king of debt. I’m great with debt. Nobody knows debt better than me,” Trump told Norah O’Donnell in an interview that aired on “CBS This Morning.” “I’ve made a fortune by using debt, and if things don’t work out I renegotiate the debt. I mean, that’s a smart thing, not a stupid thing.” “How do you renegotiate the debt?” O’Donnell followed up. “You go back and you say, hey guess what, the economy crashed,” Trump replied. “I’m going to give you back half.” (Politico)

So, there you have it. That’s where this ends if Trump’s infrastructure investment experiences debt problems. He’ll do the smart thing and write off the national debt. That, of course, will bust the entire financial world because nearly everyone owns massive chunks of the US debt colossus. As Clinton said on the campaign trail in response to Trump’s idea of defaulting our way out this funding dilemma …

“That could cause an economic catastrophe, and it would break 225 years of ironclad trust that the American economy has with Americans and with the rest of the world,” Clinton said. “Alexander Hamilton would be rolling in his grave. You see, we pay our debts.”

Ironically, Alexander already did a little rolling in his theater last week.

I don’t blame Trump’s plan for any of this. I am merely pointing out why the plan cannot save us, and how it is already showing us we are there! Default on the national debt is going to have to happen because the national debt is already unpayable, and the global economy is sinking with so much inertia that we’ll never be able to raise it fast enough to expand our way out of our debt problems because the massive amount of new debt it would take to lift the economy is going to create worse problems than what it solves.

So, I’m not concerned that Trump’s plan is going to cause the default to happen; I’m just looking at what it means for timing.

The real estate mogul countered that while he’s benefited from taking on debt in his business dealings, the U.S. is “sitting on a time bomb” with its national debt. President Barack Obama has grown the debt, Trump said, and Clinton “doesn’t have a clue” when it comes to debt reduction.

So, maybe that is the plan — take out as much debt as you possibly can before you default. Why not? If you’re going to declare bankruptcy anyway, make it worth doing by leaving yourself with assets and everyone else with empty hands. At least, we’ll be in the hands (albeit small hands) of someone who knows what do with exploding debt bombs. If done right, it will rob the banksters back.

Deutsche Bank has some idea of what the bottom looks like and what massive fall-out major defaults will cause because it probably has a fair idea of where its own numerous debt problems extend, and Deutsche just issued the following stark alarm:

…the global financial system remains broken and extremely fragile. Secular stagnation trends are everywhere. The world has too big a debt burden for the current growth environment.

The whole world has this problem, but there is no growth environment that will take us out of it because Trump’s growth program is the strongest we’ve ever seen applied, and it is already digging its own debt hole deeper, faster than it can pay for. Mere talk of the plan is increasing the plan’s financial costs (and the nation’s current debt costs) at the greatest rate of increase the US has ever experienced.

Thus, even Deutsche Bank offers a surprising statement, in spite of how bad a global default would be …

We would feel far more comfortable if the world went through a huge creative destruction period where zombie, inefficient debt was allowed to default – thus ‘right-sizing’ the ratio between debt and GDP. However we’ve long accepted that this is highly unlikely to happen outside of perhaps a future break-up of the Euro. (Zero Hedge)

So would I! Otherwise, we just get to stagnate the rest of our lives away and leave a world where our children will either do the same or be the ones to experience the default, neither of which will be good or right for them

Allowing default to happen is, as I said at the start of the Great Recession, the only way out of the Great Recession. We are wasting time and making it more likely to be much more disorderly by putting it off. It is the one answer we have been forestalling because we want to avoid the pain. Trump’s plan assures the day of reckoning for bonds gets here faster, and that is probably for the good.

As with Deutsche Bank, I say, “Bring it on because we are never going to avoid it.” We might as well put the pedal to the metal and see if we can power through this debt-sunken quagmire, and go out in a blaze of glory if we do not miraculously make it to the other side.

It’s like being up in the mountains in your four-wheel-drive while it is raining the whole time you’re up there. You turn around to head back and discover you have a three-foot-deep pond of mud across the road that you almost certainly will not make it through. So, what do you do? You roll up the windows and try to power through with all you have, even though you know you’ll probably never make it, because the alternative is walking twenty miles out of the mountains in cold rain anyway. You’re at a point where the only remaining question is “What do you have to lose?”

That’s where we are, and I think that’s why Bannon says, “We’re going to throw it at the wall and see if it sticks.” Assessing the situation realistically gives you the advantage to note this is good time to get the hip waders out of the back of the truck and put them on now, so you don’t have to cover yourself with waist-deep mud after you crawl out the window in order to walk your twenty miles soaked to the skin in mud. So, prepare!

Even the world’s largest failing bank now recognizes that a global debt default is the best way to put this problem behind us. I have consistently said that is the only way. So, prepare.

Since the world, itself, is repositioning from years of centralized globalization to national populism, the Euro breakup that Deutsche Bank seems to be hoping for could easily be as close as 2017. Brexit has begun the process. The US joined them by voting for Trexit. Italy looks about to give the Eurozone a good kick in the butt.

The world’s largest bank, which is experienced enough to have survived the Great Depression, finally recognizes the inevitability of something I have been saying from the very start of the Great Recession (which is why I continue to refer to the state we are in as “the Great Recession” because we never ended the problem but just kept pushing it forward): debt default is the only way out. Frankly, I think Deutsche knows that, if it defaults, the world defaults with it; so it would rather things start the other way around. They’d feel “more comfortable” with that because then they wouldn’t get all the blame when the world crumbles. It shows how little hope they have for their own recovery, apart from a global default.

Trumped-up hope is buying the stock market a temporary reprieve from crashing, but that only means the bond market will be the first tsunami to arrive on shore. So, while Trump’s plans may delay the Epocalypse I have written about because the scale of his planned change is so huge, it is already showing that a debt default is likely by the rapid increase in interest rates.

The world’s biggest failing bank sees no way out for the entire planet but a global catastrophe and now advocates “the sooner the better; let’s get it behind us.”

Even Trump has acknowledged from the beginning the strong possibility that it all ends in default, but he says he’s the best one to guide us through that, and maybe he is. The unfortunate part is, as he said during his campaign, that many liberal fools will blame him for a collapse that was already inevitable. People who read sites like this, however, will know when such a thing is said that it isn’t true. This calamity could be seen coming from miles away by anyone not steeped in economic denial.