https://thegreatrecession.info/blog/

The economy was already heaving in the toilet before COVID-19 dropped the lid on its head and sat on it. Sales, revenue, real earnings, manufacturing, and finally the services industry had all puked. Last week, stocks got the Great Flush as the market went down with the economy.

Be careful who you listen to in times of Great Depression. The permabulls are already telling their crowd now is the time to catch bargains and ride the market back up. Sit and think on that before your next movement.

I am saying this in ugly terms because I’ve argued with the unwavering permabull view so many times in the past. Now they’ve clearly failed, yet some are still trying to paint it pretty. They are rushing to save face over their disastrously failed forecasts for 2020 — predictions they were glibbly certain of just days ago as they bashed anyone who dared to be bearish as being ridiculous and missing the train to great success. So, I’m going to strip the paint away with blistering verbiage that fits the slough we are now in.

If the permabulls cannot learn how wrong they were from the disaster that just befell them, they deserve all I am about to give them and all they get in the days ahead from the market, too.

My self-assigned task here has always included being a critic to the majority in media and markets who join in “harmonic convergence” about the economy as they sing of the Great Bull that shall rise into the white light for eternity. It’s all bull.

Their obsessive compulsion toward praising the everlasting Bull, even when things are so obviously bad as they became this past week, grew all the more odious when I sat down early Sunday morning and read one of the permabulls I check in on from time to time as he tried to put a good face on his failed predictions:

At this point in time, I will stay with the notion that the global economic pickup has been “delayed but not destroyed“. In a typical sign of emotion being in control [of the market], not many noticed domestic and global economic data was quite positive this past week.

(I’m omitting a reference to the article or writer because I don’t want to make this personal. I’m attacking the manner of thinking, not the individual.)

The “global economic pickup.” If you’re going to paint your face pretty don’t use what comes out of your hind end to do it! It’s worse than putting lipstick on a pig. This guy is saying essentially, “Keep trusting me, even though I told you for the past months 2020 would be a great year for stocks; the bullish times will be back before you know it, so buy and hold!” These guys could sell snake oil to snakes or, uh, bull*#%! to bulls who are already full of plenty of their own.

The writer speaks of the market’s Great Flush last week as being nothing but “pure speculation” based on fear and nothing else. He’s oblivious to the fact that his own writings have been pure speculation based on hot-air hope and denial of the underlying economic realities.

Throughout the fall of 2018, I watched this guy write about how the market would stop falling in a few days, so each week’s drop was presented as a buying opportunity. Three months of that went by, and he never did own up to how wrong he had been at every plunge along the way. The permabulls have had it easy during years of Fed support, but they mislead others to their own destruction and deny their own failures when the Fed isn’t saving them. Soon they will discover the Fed is not even able to save them.

Speculation and fear resemble nitro and glycerin.

Yes, and speculation and hope resemble a match and a fart.

The present corona-calamity has befallen an already pooped economy, stinking with debt, rotten with corruption, careening down a chasm of disparity between the rich and the rest, and grossly overpriced in the stock market, while riddled with zombie corporations whose debt will now go from “junk” to sewage because we have entered a time when money is overflowing into safe havens, not leaping for opportunities to take more risk. So, the cost of zombie debt is likely to rise while everything else disappears downward with gurgling sounds. (Just calling it what it is to strip the varnish off this painted pig.)

I follow a plan and a strategy that allows me to proceed without emotion. That same plan offered assistance in 2016, December 2018 and it will once again do so today.

As he takes solace in how his buy-and-hold plan kept him in for every recovery, what this counselor doesn’t say is that he followed that plan at the start of the drop in January of 2016, too, which is why he took the entire fall and needed to recover in the first place; and he followed the market down in October, 2018, too, all the way to December. Now, he is following his buy-and-hold plan throughout the present plunge and encouraging all his followers to take the ride with him … again. And they will. What a thrill!

The plethora of bullheaded writers like the one I read Sunday morning (until I couldn’t stomach him any longer) are the reason I have to keep laying out the statistics that show the relentless economic drain, which the permabulls in their durable denial remain oblivious to or gloss over even as they are swimming in writhing waters, circling the porcelain bowl.

It is only obvious that, if you stay on a buy-and-hold plan, it will allow you to take every rally up there is, but it also means you to take the full brunt of every fall there was. So, it’s a dumb plan! Use your head. When things look perilous, take precaution. And they never looked more overpriced and perilous than this market looked.

FEAR will always win the debate. It will continue to do so until at some point common sense prevails. The issue is we just don’t know when that may occur. For some, it never occurs.

Oh, the irony, as a statement like that flows out of one who has never had the common sense to get out when the market is perched in palpable peril and who, like Sisyphus, takes every fall all the way to the bottom again and again. Common sense tells you to get out of the way!

When you see the market is clearly behaving irrationally with great exuberance by ignoring bad news and even sometimes buying up on it, as it did in the last two months, have the sense to get out! The signs were abundant. Plenty of wiser people saw the problem and warned others repeatedly to get out if they didn’t like huge amounts of risk, such as chart-man Sven Henrich:

Complacency came before the fall. All of 2019 market participants ignored the non existent earnings growth. Too strong was the now pavlovian reflex to chase easy central bank money. Too trusting in central banks to again produce a reflation scenario that would make all the troubles go away. Everything was ignored and markets and stocks were relentless chased higher into some of the highest market valuations ever. Even the coronavirus was ignored. A dip to buy in January they said. AAPL warning? Let’s ignore it and buy AAPL to new all time highs again. Then markets crashed last week. Perhaps not in percentage terms, but in terms of vertical velocity to the downside it was unmatched in history. The fastest 15% correction off of all time highs ever and by far.

Northman Trader

The light-headed rise of a delirious market in the face of such long and continuing economic decline should have persuaded the writer whose approach I am criticizing that the market’s last melt-up rally was not a path to be pursued. Instead, he paddled merrily over what even he admits was “a waterfall decline … similar to December 2018,” and his followers went screaming over it with him. And that’s how permabulls lose 20% only to do it all over again and sometimes a lot more.

He, then, even ponders those who wonder if this 16% plunger will become a cascade into a bear market and derides those who act so emotionally based on fear. He actually suggests they should stay in the market because, if it is a bear, that will make itself obvious when the market is finally down 20%! Sure it will, and then he’ll counsel them to stay in and see if it ever makes it down 40%. Such is the buy-and-hold permabull mentality:

Believe me, IF this is the onset of more market weakness ahead, things will get worse, and one needs to know how they are going to react when that happens.

Why didn’t they react before this last disaster happened? Why do his readers need “more market weakness” before they react? Why did they need any market weakness when investor irrationality was and is so obvious? When the market falls at a time when it should be falling, why not sell and hold until the bad news clears or the Fed actually steps in with its magic money, instead of the mere assurance it gave Friday that it will keeping an eye on things and will respond as needed?

(And, as an aside, how much do you want to bet that this black swan event — or black bat virus — just kicked the Fed’s plan to start unwinding its repos into oblivion, which is where I said that plan would wind up going?)

I am aware that the next bear market could be coming, just as I was aware of the possibility in 2016 and December of 2018.

So, why wait until it is fully established, just as he did with the drop throughout the 2018 dive? An admission like that one is hardly something to boast about. He hears the roar of the falls, sees the mist on the river up ahead and feels the swifter current and doesn’t have the common sense to paddle his canoe to shore and do a little portage around the falls?

No, let’s go over it, and when we get to the bottom, then we’ll know it was a bear market! Yeah, that makes sense. Let’s wait until we KNOW it’s a bear market because, well, “Who could have seen this coming?”

Uh, anybody.

Apparently it doesn’t matter, even if you do see it coming. The permaplan is stay on board and go over the falls.

The skeptics aren’t telling me anything I don’t already know.

I’m sure they never tell him anything because he never listens.

He lets you know he could see it coming and still didn’t have the sense to get out of the boat. That’s because his brand of all-to-common sense among bulls tells you to stay in the boat and do not fear anything that appears to lie ahead. Wait until you get there! Wait until you go over the edge, and then you will know for certain it was problem you should have missed.

Premature decisions lead to huge mistakes.

Uh, so do post-mature ones. Don’t wait until the bottom of the waterfall to drag your pummeled flesh out of your splintered boat. If you’re traveling down an uncharted river and are smart enough to know that swifter current, rising mist from the center of the river, and a faint roar might be a waterfall, get out of the boat!

Statistical changes that will be pouring over the falls during the days ahead will be far more dire than those I was already sharing before the coronavirus scare. (Here, here, and here.) I’ll warn you: the “global economic pickup” he says is still coming is a beat-up 1950’s Chevy Apache, backing downhill at full throttle without any brakes. So, stay on that ride in the back of the truck if you want. It’s bound to be a thrill.

I write this diatribe now because I know the masterminds of our economic demise — those bonker brokers, Fed-head deadheads, and crack-head commentators like Krazy Kudlow will now all blame the ready COVID-19 scapegoat for the economic recession that has been gaping wider beneath us since last summer. We will, thus, again miss the lesson that could have been learned!

Yes, COVID-19 is certainly turning the economic sickness into a plunge, but it is able to do so because the entire economy was FAR from being the “strong economy” President Trumpet and Reserved Powell have been consistently boasting about. With their fiscal and monetary support, people of the permabull mind helped create this mess by pursuing empty philosophies. So, may they all pay the heavy price of their own failures.

Yet, it will be everyone but those at the top who pay. Trump can always retire to his golf courses, and Powell can print himself and his bankster buddies some more money. They are skilled in bailing out their gilded canoes after disaster strikes.

Powell’s next money puke may give the market a dead-cat bounce, as might other CB intervention, but on what basis would one assume the market is going to make the long swim back up the waterfall? The economic down flow from the coronavirus just touched the US last week. Common sense should tell you there is plenty more to play through for awhile. So, at least, let the market get the bad stuff out of its system. (Unless you’re a superhuman river rafter who can ride a dead cat upriver.)

In fact, the Fed may soon find itself constrained from doing anything. This recession is now morphing into a supply-side recession. That is especially bad news because it means business is no longer just falling due to diminished demand, coronavirus is causing business to fall because of diminished labor and suppliess. In China, goods are not getting manufactured or shipped because people aren’t going to work. In other countries, goods are not getting manufactured because manufacturers cannot get their essential components out of China.

If the fall in supply outstrips already softening demand (which is falling faster now due to people not going out to eat or shop as much and not traveling as much), we’ll have shortages. Scarcity means rapidly increasing prices, and that means the Fed will have no room to lower interest rates. Bottom line: you cannot fight a supply-side recession with monetary policy or fiscal policy.

In this develops into a supply-side recession, we may all see something highly peculiar. The Fed would still be tempted to cut rates to stimulate the stock market just because investors are so conditioned to buy when the Fed cuts rates or creates money. If it does, you might see the market go up even as the economy falls faster. That would happen because the Fed has no impact on the economy in a supply-side recession, but the market is conditioned to bet stocks up regardless. That would most likely play out like Wile E. Coyote running out over a cliff, looking down, and then falling like an anvil. The market would rise until it realizes the economy is falling in spite of the Fed rate cuts, and then the market would crash even harder than it just has because investors suddenly realize they have bid out over nothing at all.

Now for a brief update on market stats since my last articles referenced above, and then an overview via video on how truly bad last week’s crash was and how unmistakably and easily last weak’s waterfall from an expert at charting the market stream (since I don’t do charts).

First, a moment of relief

Even when you’re hatching the toilet, moments of relief do come. New home sales have more than recovered from their year of constipation, though the number of sales is still well below housing’s former glory days, pre-Great-Recession. That doesn’t take away much from what I said when I called the housing market’s decline because I said back then the housing market would 1) NOT be the cause of our next Great Recession and that 2) housing would not fall nearly as badly as it did during the Great Recession. It was just one of many markets falling into trouble. (Existing home sales have yet to come around.)

Now the bad and the ugly

Look at how orders of durable goods had been trending in recession for almost a year and continued their downward trend of lower and lower spikes in January:

It’s no wonder the Richmond Fed’s manufacturing survey crashed back into recession in February at -2, which undershot the +10 economists had expected by a wide margin. Hardly a sign of “recent economic pickup.”

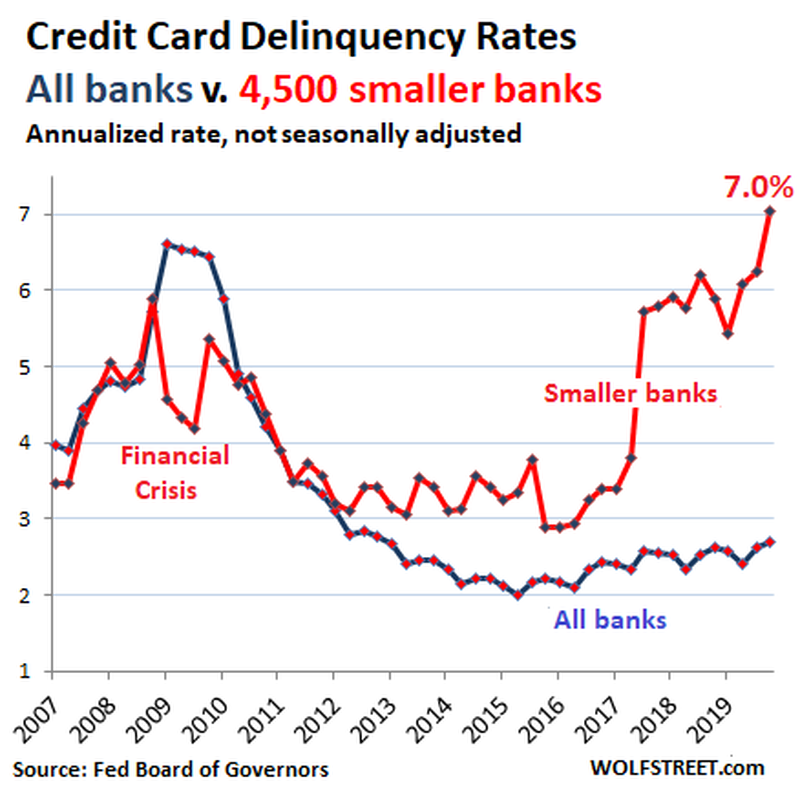

Look at where subprime credit card delinquencies have been trending for years, which, after leveling off in 2018, went on a rocket ride again throughout 2019:

This is what happens in a strong economy? This is a sign that consumer sentiment, the only thing everyone acknowledged was carrying the economy by the time 2020 began, is going to remain strong? How strange to see someone arguing from “common sense” who has so little of it!

Finally, now that the market has fallen, is it cheap yet? Has it purged all the stupidity? Let’s see:

Nope. Looks like it is running well ahead of the economy still … based on the last thirty years anyway. So, what rational basis is there for speculation and hope that the market will take another run up Sisyphus’ mountain? Sure, it could, especially if the coronavirus is magically cured next week or if the Fed leaps in with MagicMoney. Even if it does, the economy is going down while the market goes up, so I think I’ll stay on the side in caution for a bit to see how things turn out. I don’t care if I miss the first 10% of the next fool’s rally.

And now the downright hideous

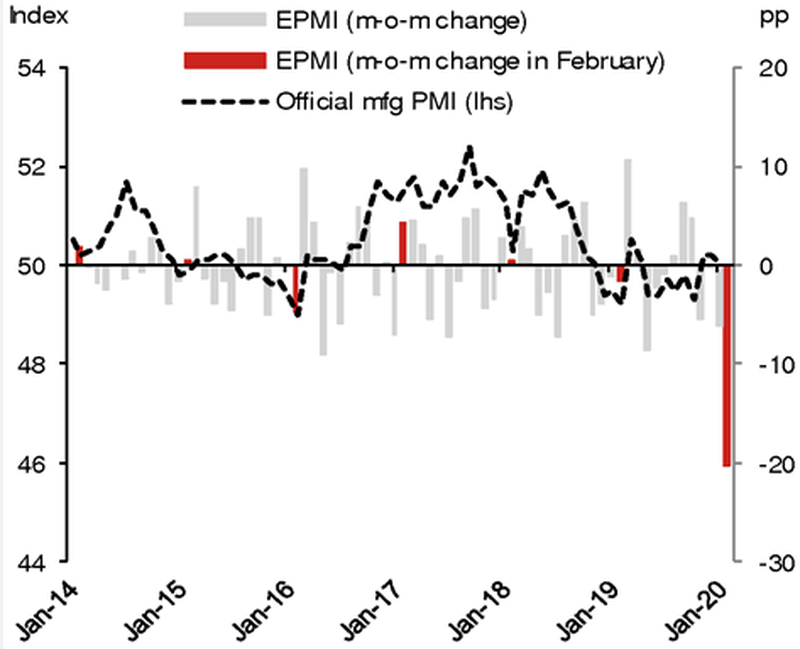

“China Reports Catastrophic Data: PMIs Crash To Record Low, Confirming Coronavirus Collapse“

In one month, China’s economy plunged as deep into recession as it was during the belly of the Great Recession. With China being the world’s second-largest economy now, and the main economic engine that helped pull the world back out of the Great Recession, what is going to pull the world out of the present economic crisis before it turns into all-out economic collapse?

“These are not recessionary levels, but outright depressionary,” wrote Michael Every of Rabobank.

The graph shows that China’s economy (based largely on manufacturing that long ago fled the US thanks to the Bush dynasty) was clearly one more thing that was in decline throughout all of 2019, but it just went over the waterfall.

“Holy Crap!” this trader says, sizing up last week

“Biggest bull trap ever seen! This was a crash! Never seen anything like this. Off the chart! Significant technical damage. Absolutely historic readings! Totally irresponsible by the Fed.”

I’ll let Sven Henrich lay out in total and clear detail for you via all of his charted technical warnings that came before the Great Flush and his charted technical damage since: (No one does it better.)

It all comes out in the end

What a confirmation of what I warned of in January: “Stock Market More Overpriced and Perilous Than Anytime in History.”

As they say, a good flush beats a full house. So, yeah, buy and hold. Hold your breath, that is. Buy-and-hold is the American Standard plan! Oh, the stuff that comes out of a bull as he disappears down the porcelain hole, such as “how the economy was picking up” even though he had long been saying, “The economy is strong.” (If it was so strong, why is it now “picking up?”) No, it was backing up.

It’s unbelievable how much crap bulls can put out and how they just cannot learn … even from experience. Wow!

Flush!