You may not see it yet, but the scale of the retail apocalypse is so massive that it is about to engulf the US economy. As when a flood tide has crept around you on all sides while you were standing on a high spot out on the flats, not paying attention, you can look up now and see it all around you, and it is coming in rapidly. You can now feel the current under your toes.

You may not see it yet, but the scale of the retail apocalypse is so massive that it is about to engulf the US economy. As when a flood tide has crept around you on all sides while you were standing on a high spot out on the flats, not paying attention, you can look up now and see it all around you, and it is coming in rapidly. You can now feel the current under your toes.Since the final quarter of 2015, I have been writing about what I call “the Epocalypse,” by which I mean an economic collapse that will prove to be apocalyptic in scale — something that is both epic (Herculean) in scale and epoch in the literal sense that it will dramatically bring the modern world into a new economic era. I might better, then, call this the “retail epocalypse” because it has insidiously turned into a significant part of that greater event and because it is partly due to e-trade.

While you may have barely begun to see the boarded stores, the numbers now coming in for stores slated for closure and/or bankruptcy in 2017 and 2018 are jaw-dropping, and I’m not using that term lightly.

First, some back story to the retail apocalypse

In case you are just arriving at this blog, let me start with a little recent summary of where I have been going with this staggering development so that you can get a sense of how incredibly fast the momentum of the retail apocalypse (retail collapse) is now building:

While I’ve talked about it for a year or more, in my March, 2017, economic forecast, I particularly described “seven headwinds that will batter the economy.” At the close of that summary, I mentioned how retail was likely to blow up into a major problem this year:

More retail closures are in the works. JC Penny announced last week that it will close another 130-140 stores, citing weak demand and online competition. Macy’s recently announced it will be closing 100 stores, too. Macy’s said profit fell another 13%, and it expects a 3% decline in sales in 2017. Kohl’s and Nordstrom are keeping things in line by reducing inventory and cutting back on promotions.

I doubled down on that in May, coming more to the point by calling it a “retail apocalypse,” as a few other writers were starting to do at the same time:

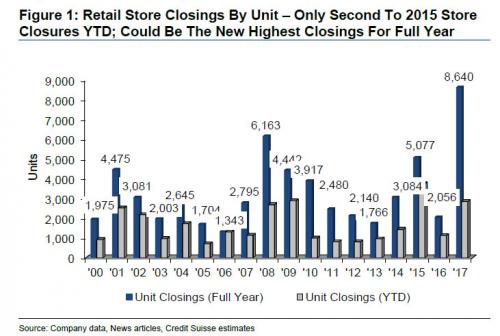

The retail apocalypse grows: Not even halfway through 2017, closures of retail stores have doubled last year’s closures as of this time and already exceed the last peak in closures during the crash of 2008. The bottom line is simple here. Commercial eal-estate investment trusts (REITs), malls, mortgage-backed securities (remember those), and their bankers are in a lot of trouble. The anchor stores are closing up the worst, which will pull others down in the wake by reducing traffic to malls. “Thousands of new doors opened and rents soared. This created a bubble, and like housing, that bubble has now burst.” According to Credit Suisse, 20-25% of US shopping malls will shut down within the next five years. While this is due to a paradigm shift in how people do their shopping, not just an overall reduction in retail sales, it will send shudders and close shutters throughout real-estate-based retail economy, having a huge impact on construction, land sales, banking, jobs, etc.

That was less than two months ago, and now many are calling it a retail apocalypse. If you think we’re exaggerating with colossal words, read on…

The numbers for the retail apocalypse are fully before us, and they are downright frightening

This thing is MASSIVE, ABSOLUTELY AWE-INSPIRING IN SCALE, and I can use those kinds of descriptions and not be exaggerating in the least because this retail meltdown already exceeds anything seen in my lifetime (58 years). There is also nothing Trump or anyone can do that will stop it because the tide has already closed around us — quietly and almost unseen, though in full sight the whole time. These major retail store closures are already scheduled and being implemented now. The boards on the windows start arriving on convoys of semi trucks all across the nation this summer.

Before presenting the numbers that prove the retail apocalypse, I’m going to let Harry Dent give some colorful perspective as to how this calamity is going to end up:

It’s like a scene out of “Resident Evil.”

Sheets of newspaper scratch along the dusty linoleum floor as the wind beats them into the remnants of a bench… or through the open glass door and into the darkened, empty space beyond.

Escalators haven’t run in decades.

The air itself looks dusty.

Could this really be the future of the American mall?

Not unless we have a nuclear apocalypse!

As for this retail apocalypse you’ve been hearing so much about…

Well, it’s bad – yes! – and it’s going to get worse, but I’m writing today to tell you it was totally predictable!

Indeed, it was predictable, and it’s been predicted here for well over a year, but particularly of late as we have closed in on its arrival. The retail apocalypse has moved from the realm of a growing threat and economic predictions to a full-on event that is happening all around us.

Here are the numbers: So far a total of twenty-three-thousand stores (I spelled it out to give you appropriate pause as to the enormity) are already scheduled for closure in 2017 and 2018. Those are numbers that will not be turned back, even if Trump’s plans do make it through congress. The legal work has already been drafted and the plywood for the windows is already being shipped.

After more than a dozen bankruptcies this year contributed to thousands of store closures, visibility for the industry is so poor that retailers are pushing for lease renewals as short as a year or two — down from five to 10 years…. Somewhere between 9,000 and 10,000 stores will close in the U.S. this year, said Garrick Brown, vice president of Americas retail research for commercial broker Cushman & Wakefield — more than twice as many as the 4,000 last year. He sees this figure rising to about 13,000 next year. “Everyone’s trying to figure out where the bottom of the market’s going to be,” Brown said. He estimates it could occur in 2018 or early 2019…. Even companies that are relatively healthy are moving to prune back hundreds of store locations, making it less obvious for property owners which tenants they may lose.Deterioration can come fast: Some retailers that were in good shape a year ago are now on the edge today…. Cushman & Wakefield’s Brown sees about 300 of 1,150 U.S. malls shutting down in the next five years. (Bloomberg)

In other words, the economic impact is already baked in, even though visibly it is just now becoming obvious everywhere.

Harry Dent points out that this was predictable because of his central thesis that baby boomers are moving out of the boom stage when they spend big into the fixed-income stage where they have to cut back. Others have pointed out that retail stores are closing because millennials, who are replacing the boomers, prefer to shop electronically. Some stores are closing because they are dinosaurs who didn’t keep up with fashion or who ran bad business models. And some of the retail collapse is due to people just not having expendable income in a world saturated with towering debt and long-stagnant income and declining benefits. Still others are collapsing because rents are back to being insane. All of those reasons are true, and all of them are why there is nothing Trump or the Federal Reserve can do to stop the retail apocalypse that is already all around us.

How the retail apocalypse will overwhelm the entire US economy

You might think, well if this is just about millennials and even house-bound or rest-home-bound boomers moving toward online shopping, then there is no net economic impact. Shopping has just moved online so the same revenue is being generated but in different places. Absolutely wrong for three major reason: 1) The growth in online retail sales falls short of the decline in brick-and-mortar sales; so there is a large net loss to GDP. 2) Online retailers like Amazon are greatly automated and more efficient by far than stores using bipedal employees. Amazon uses robots. So, there is a corresponding large net loss to employment that has just begun. 3) The closure of major retailers carries a formidable knock-on effect — a cascade of inevitable economic crises, and here is how that all plays out:

The predominant stores that are closing are the anchor stores in malls and shopping centers — Macey’s, Sears, J.C. Penny’s, etc. and smaller luxury stores. (Sears, already in dreadful condition, saw sales fall another 20% year-on-year.) While many small, lower-end stores are also closing due to economic difficulties (like Radio Shack), anchor stores are the ones that create traffic in malls. Few malls have been able to survive without anchor stores because those large stores are the linchpin that keeps the wheels on their business plans, and while malls might be able to re-invent themselves, that will take a lot of time and trial and error for them to figure out how to do so; and most do not have that kind of time because of their debt.

When anchor stores shutter up, mall traffic (already falling badly) seriously declines. That means all the stores around the anchor stores begin to go out of business. That means the restaurants in and around the malls and shopping centers begin to go out of business. That means some of the gas stops even begin to go out of business. That means huge unemployment all across the country, and that means all kinds of other stores go out of business, repeating the entire cycle. And all of that means government revenue crashes just as the government needs strong revenue to do its own fiscal stimulus programs.

And all of that is inevitable with the imposing number of closures that are already fully in play. This is basic cause and effect. It’s math. You cannot board up 23,000 stores across the country without creating huge amounts of collateral damage all around those closures.

That brings us to the impact on construction of new commercial space. Not only will new malls and stores certainly not be built, but the low rents that will be offered to get anyone into malls will make sure that a lot of other commercial space does not get built. When 23,000 stores close, that obviously makes 23,000 new commercial vacancies to be filled. Many of these are very large spaces. Banks are not going to finance new commercial space when so much commercial space is vacant and when they are facing defaults by other commercial developers. So, there goes commercial construction of new spaces and many construction jobs.

That, finally brings us to the knock-on effect of this retail apocalypse to all the financiers of major malls and shopping centers. That probably won’t be felt for another year; but it certainly will be felt. Closing malls equal defaulting malls. All of that equals defaulting real estate investment trusts (REITs) as well.

This whole cascade of events is as predicable in light of what is happening right now as the fall of a row of dominoes; yet, watch how many people continue to deny it is happening because they don’t like what it says about the economy. The blindness will be stunning (and already is) for those of us who removed our rose-colored shades long ago (or never wore such things). Take for example this recent optimistic statement in an article about retail:

Growth is expected to pick up this quarter after being held back by a near stall in consumer spending and a slower pace of inventory investment at the start of the year. (Newsmax)

Really? How? How is retail growth going to pick up with 23,000 stores closing over the next two years, and that is counting only those that are already slated for closure! If it does pick up, it will be nothing but a temporary quarterly blip; but I don’t see even that happening. It’s stunning that anyone can even make such a blind statement.

This retail collapse is a paradigm shift, and while it may be good in the long-run, leading to a world less dominated by asphalt, automobiles and pollution, economically it is the end of the Jurassic Period. The new mammals have yet to arrive on the scene. For the next few years, the predominant scene will just be the stinking entrails of all the gutted retail dinosaurs. You don’t get to the new era without going through the extinction phase first. Not in this case, anyway.

Continues Newsmax,

May’s surprise sluggishness in consumer spending, which accounts for more than two-thirds of the U.S. economy, could worry Federal Reserve officials who have previously attributed the slowdown in domestic demand to transitory factors.

Of course it didn’t, as I promised it wouldn’t. The minds of the Federal Reserve would only be considered bright on a string of otherwise burnt-out light bulbs. These dimwits believe in their recovery, so I promised you they would raise interest rates even as we are entering the gaping maw of a massive economic collapse.

That is their MO. They always raise rates just as economic collapse is becoming obvious. It is practically their favorite thing to do. That means they are either the dumbest people on the planet, since this is supposed to be the area of their expertise, or they’re involved in a conspiracy. (Maybe this time to take out Trump? I still lean to all-out stupid, but it becomes increasingly hard to believe that people with such high IQ’s can really be this dumb! So, maybe this is just my own residual reticence toward conspiracy theories.)

The retail apocalypse’s chain-reaction to the chain restaurants

Bear in mind that the shopper count is already WAY DOWN. That is WHY the major retailers and others are already closing. What I am saying above is that their closure will bring an even larger wave of decline by leaving the remaining shoppers with 23,000 fewer places to shop! With shopper count already being way down, the impact on restaurants is also already being felt:

There’s simply no respite for chain restaurants. Industry-wide, same-store sales fell again in May. The last time, same-store sales actually rose year-over-year was in February 2016. On that basis, the chain-restaurant recession is now in its 15th month, the longest downturn since the Financial Crisis. In May, same store sales fell 1.1% year-over-year. Same-store foot traffic fell 3.0%. Food sales were down, and alcohol sales [in chain restaurants] were down (Wolf Street)

How much worse will restaurant traffic have become when another of their 23,000 neighboring stores have closed? And that is in contrast to last year’s chain restaurant sales, which were already terrible! Not only has this slide been developing for well over a year, but last month was its biggest monthly drop to date. It is the chain restaurants that are feeling it because they are the ones most likely to locate in malls and shopping centers. In fact, the number of distressed retailers and restaurants right now each top the total seen in the entire Financial Crisis.

Wolf summarizes the causes this way:

…It looks more like the beginnings of a broader structural change. Brick-and-mortar retailers have been getting hammered by a structural change that will never reverse. Chain restaurants too may feel the pressure from a change in where, what, and how consumers eat and drink that will leave chain restaurants that cannot adjust to it by the wayside.

This comes on top of an economy where many potential patrons of chain restaurants simply don’t have enough discretionary income after paying for all essentials….

This is a major extinction event, and that’s why I don’t think calling it a “retail apocalypse” is overblown. The retail giants that cannot adapt are already perishing. They are already gathered in massive numbers around their diminishing watering holes to die. On the bright side, drinking establishments are way up in sales. Is it any wonder?

List of retailers already drowning in the retail apocalypse

The following is a list of major retailers shutting down large numbers of stores and/or filing for bankruptcy:

- Macy’s Inc., closing 100 underperforming stores, 68 this year.

- Signet Jewelers Ltd., which owns the Kay, Zales and Jared brands, closing 165 to 170 stores.

- Lululemon Athletica Inc., closing 40 stores operated under its Ivivva brand.

- Neiman Marcus.

- Michael Kors Holdings Ltd.

- J.C. Penney Co., closing 138 stores in 2017.

- Sears Holdings Corp., closing 41 more stores in 2017.

- Children’s Place Inc.

- Payless Inc., 400 stores to close in 2017

- 99 Cents Only Stores LLC.

- Charming Charlie LLC.

- Gymboree Corp.

- Nine West Holdings Inc.

- NYDJ Apparel LLC.

- rue21, Inc., 400 stores to close in 2017.

- True Religion Apparel Inc.

- Radio Shack, 550 stores to close in 2017.

- The Limited, 250 stores.

- Family Christian Bookstores, 240 stores.

- Bebe, 180 stores.

- Wet Seal, 170 stores.

- Crocs, 160.

- BCBG, 120.

- America Apparel, 110.

- K-Mart, 109.

- hhgreg, 88.

- Staples, 70.

- CVS, 70.

- Abercrombie & Fitch, 60

- Guess, 60.

- Gender Mountain, 30.

As you can see, many of these are the mammoths of retail, some of which have been hugely successful for a hundred years or more. Also deeply at risk of default for various reasons, according to Standard & Poors and other sources:

- DGSE Companies, Inc.

- Appliance Recycling Center of America, Inc.

- The Bon-Ton Stores, Inc.

- Destination XL Group, Inc.

- Perfumania Holdings, Inc.

- Fenix Parts, Inc.

- Tailored Brands, Inc.

- Boardriders SA, sporting subsidiary of Quiksilver.

- Fairway Group Holdings, food retailer.

- Tops Holding II, supermarket operator.

- TOMS Shoes.

- David’s Bridal.

- Evergreen AcqCo 1 LP, parent of thrift chain Savers.

- Vince LLC, clothing retailer.

- Calques Acquisition, owner of Cole Haan footwear.

- Charlotte Russe, women’s clothing.

- Indra Holdings, owner of Totes Isotonic.

- Chinos Intermediate Holdings, parent of J. Crew Group.

- Everest Holdings, manages Eddie Bauer.

- Nine West Holdings, clothing, shoes and accessories.

- Claire’s Stores, accessories and jewelry.

- Saks Fifth Avenue.

- Lord & Taylor, parent of Hudson’s Bay Co.

Those lists are probably not exhaustive. They are just what I pulled together from a variety of sources. And all of that is just the beginning:

Perry Mandarino, senior managing director and head of corporate finance at B. Riley & Co., predicts that retail bankruptcies and restructurings will further accelerate in 2018. (Newsmax)

Accelerate? How do you get faster than the tidal waves that are already washing on shore? The number of stores that have already closed or have scheduled closing for 2017 is by far the largest in, at least, the last twenty years:

Retail bankruptcies for 2017 also already exceed the entire year of 2016, and we’re only halfway through the year. One Moody’s market analyst writes that retailers on the credit-rating agency’s endangered species list looks like The Perfect Storm:

“You’re on the Andrea Gail right now, and the water’s starting to get very choppy.” (Ventura County Star)

Historically speaking, few of us have ever seen anything in retail like the apocalypse that is emerging all around us right now. And retail is just one of the areas of the economy that is collapsing, but it is already going down on a grand scale.