![]()

Zombie Economy Soon to Have its Zombie Epocalypse

![By Charlie Llewellin (Flickr: Occupy Austin) [CC BY-SA 2.0 (http://creativecommons.org/licenses/by-sa/2.0)], via Wikimedia Commons](http://thegreatrecession.info/blog/wp-content/uploads/Zombie_Economics.jpg) This past Thursday marked the one-year anniversary of the US stock market’s death when stocks saw their last high. Market bulls have spent a year looking like the walking dead. They’ve tried to push back up to that distant high that means new life several times, but each time the market falls into a pit again.

This past Thursday marked the one-year anniversary of the US stock market’s death when stocks saw their last high. Market bulls have spent a year looking like the walking dead. They’ve tried to push back up to that distant high that means new life several times, but each time the market falls into a pit again.The market’s inability to rise without falling again is getting to be nerve racking for those who stayed in the market, trying to make it work for themselves. For Dennis Gartman, who writes the very influential Gartman Letter, last Wednesday was, in fact, one of the worst career days of his life:

Having been 150 Dow points higher and then only moments later to have traded down to where the Dow was suddenly 150 lower, the market finished effectively unchanged, with the Bulls and the Bears left scratching their heads and wondering aloud, “What the hell just happened?” …Yesterday was our worst day of the year thus far, as that which we were long of fell and that which we were short of closed unchanged. Long ago we learned that when things go awry and do so as “majestically” as they did yesterday it is best to simplify, simplify and to simplify again. Getting smaller; getting less involved; curtailing positions in numbers and sizes is the only proper way to respond and so we did exactly that…. Yesterday was a disaster which we wish to put behind us, and by getting smaller and less widely involved we are in the process of doing so. (Zero Hedge)

These are the last gasps of a stock market (and economy) that is struggling to rise again to new highs, which it simply cannot do now that QE has been turned off and the oxygen tank of zero interest is being slowly turned down. I’ve said it wouldn’t be able to, and it hasn’t. It’s spent a year proving I’m right about that, never breaking through that ceiling into a realm of new life.

The zombie “bull market” doesn’t know it’s dead

While Wednesday was a day for some to retrench and rethink their strategies, Thursday’s anniversary of that last (now very distant) market high was no cause of celebration either. Stocks jolted downward again — nearly a hundred points on the Dow. If you bought the market indexes a year ago and just sat on your investment, you’d be 4-5% poorer today. Yet, some still call this a “bull market.”

Earnings growth for companies in the S&P 500 has shrunk for three quarters in a row while companies piled up on debt to keep their stock prices from falling by cannibalistizing themselves with stock buybacks. As I wrote in another article, buybacks are ending. Their support for the stock market is rapidly deteriorating. Yet, some still call this a “bull market.”

Wall Street blew off news that Walmart (which has been closing stores left and right) reported significantly improve earnings and focused on repeated hints of a Federal Reserve interest-rate hike in June. The bulls are back to their one-track obsession with the Fed as being the only real money in town. Even the revival oil prices failed to lift spirits. So, the Dow closed lower for its fourth week in a row. Yet, some still call this a “bull market.”

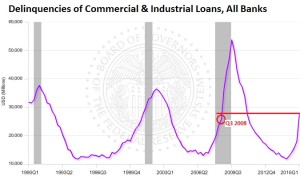

The pileup of corporate debt reached critical mass and is now a mushroom cloud. Since the close of 2014, delinquencies in commercial and industrial loans have spiked 124% to reach a point higher than they were in 2008 when Lehman Bros. crashed.

The following chart shows where we stand in the commercial-industrial credit cycle. You can see that the last two times delinquencies rose this high, we were in or just entering a recession.

Yet, some still call this a “bull market,” and they say they see no recession anywhere in sight.

Delinquencies in agricultural loans in the US right now are in equally bad shape due to prices that have been slumping as badly as oil. As a result, farmland in Illinois is now selling at 20-30% less than it was a year ago. Not a big help to heavy equipment manufacturers either.

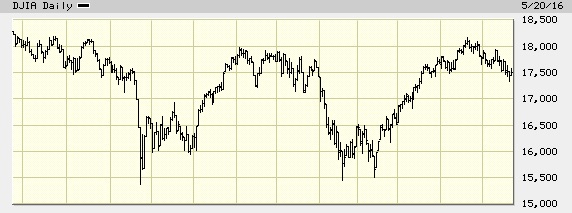

Here’s the past year for the Dow:

Does that look like a bull market to you? Since we are lower than where we were a year ago and have never once risen to where we were a year ago, it looks like a roller-coaster ride to nowhere to me. It’s time for this zombie economy to get a stake through its head so we can start building a real economy.

Caterpillar’s slow crawl toward death

Things are still going terribly bad for Caterpillar. During the trough of the Great Recession, Caterpillar posted nineteen months of falling sales. That was nothing compared to the “recovery.” After a revival in the first part of the Fed’s faulty recovery, Caterpillar slumped into global decline for 41 consecutive months. Sales fell more steeply during the Great Recession; but they have fallen more relentlessly over the last four years, and US sales fell faster in April than in March.

Thus, Caterpillar has relied heavily on stock buybacks and boosted dividends to keep investors satisfied. As it goes with this bellwether, so it goes for most of the rest of heavy equipment manufacturers. Buybacks became the corporate norm that drove the illusion of a stock market boom since the end of 2009; but as explained in the article referenced above, buybacks may be entering the autumn years of their decline.

Caterpillar’s slow death crawl epitomizes the zombie economy that the Fed calls “recovery.”

The Fed is stuck in low gear in its own quagmire

![By Charlie Llewellin (Flickr: Occupy Austin) [CC BY-SA 2.0 (http://creativecommons.org/licenses/by-sa/2.0)], via Wikimedia Commons](http://thegreatrecession.info/blog/wp-content/uploads/Zombie-Epocalypse-Brains-Needed.jpg) Steven Major, global head of fixed-income research at HSBC, thinks a Fed rate hike is “out of the question” for June and for a very long time to come:

Steven Major, global head of fixed-income research at HSBC, thinks a Fed rate hike is “out of the question” for June and for a very long time to come:

If the Fed and others were to hike this year, there’s a material risk that they might have to reverse it next year. If that’s the case, then don’t do anything…. The market is now ready for a long, long time of very low rates. And it’s been painful because there are people that have been expecting the Fed to do what it’s said it’s going to do. So, the Fed really wants to hike rates, but it can’t…. So, I think that we’re stuck with very low yields for a very long time…. I’m not forecasting the hike. I think it’s out of the question; but the fact is everybody else has now come around to the same view. (Bloomberg)

Bonds have become a zombie economy, too, and the Fed has become the parade master of the walking dead. Stocks slobber and bonds drool over the chuck-holed street that could have been fixed as a stimulus work project with the money that went to boost banks.

Major’s description of where we are now matches my own prediction last year that we’d see one Fed rate hike at the end of fall in 2015 and then the Fed would find that its singular hike ended its illusion of recovery so that it would not be able to raise rates again. Half a year after the first rate hike, things clearly look worse than they did when the rate hike happened.

Since I believed the stock market would crash after the first rate hike (as we saw in the worst January in stock market history), I said no rate hikes would be possible after that. In fact, the Fed would find itself pressed to go back into stimulus mode as much as it would hate to do so … because we would begin to descend into the belly of the epocalypse.

I think the Fed began talking up rate hikes last week in order to boost the illusion that it actually can raise rates (so people won’t think all is lost), but it will find external reasons (reasons outside the US economy) for saying it would not be “wise” to raise rates at present. I think the Fed will choose to exercise “patience” in the face of these international pressures. By hinting at the likelihood of a rate hike now, they may get a little euphoric market boost in June if they do not raise rates now that they’ve created some fear that they will.

As Majors says, the Fed desperately wants to raise rates in order to achieve credibility and prove its recovery an ongoing success. I believe that desire is so intense that my prediction that it can’t raise rates doesn’t mean that it won’t. If it succumbs to that desire, it will be a huge mistake (in terms of the Fed’s own recovery illusion). It means we’ll see the next leg of this ongoing crash a little sooner because it will be the Fed who finally put the stake through the zombie’s head.

Based on its repeated declarations that a rate hike is dependent on inflation and job data, the Fed risks seriously losing face if it does not raise rates this June because consumer prices saw their biggest increase in three years in April due to gasoline rising and rents along with some increase in medical and food costs. CPI rose almost half a percent in one month. Job growth, while wavering, is still hovering in the Fed’s desired data range.

Whether the Fed raises rates or not, the zombie economy is going down. The actions of all central banks are becoming increasingly desperate, which is not what you’d expect if the past seven years had been some form of recovery. You would expect the most desperate actions to have been taken at the bottom of the crisis with stimulus measures gradually being weened away as things improved. Instead, we see stimulus measures becoming outlandishly desperate everywhere but in the US, and the US will soon find it is not immune to any of this.

The deputy governor of Sweden’s central bank, Cecelia Skingsley, described how desperate things are getting for central banks all over the world:

“If monetary policy seems to have lost its magic touch, what can central banks do?” …Despite negative interest rates and other monetary policy stimulation, inflation is far below target in many countries. Scope for monetary policy seems, quite simply, to be shrinking…. There may arise situations in which [smaller] countries’ central banks become highly dependent on the actions of larger central banks…. Alongside cutting the policy rate to below zero and purchasing securities, so-called helicopter money could provide a hypothetical path to take to increase scope for monetary policy. “…Considering the difficulties that are weighing many of the world’s economies down, I think that it is wise to discuss the different possibilities, without closing any doors.” (Riksbank)

We increasingly hear this bizarre talk from desperate central banks all over the world: “It may be time to print money out of thin air and throw it out of helicopters to the masses as the last resort to save the global economy.”

The Fed is stuck in its own quagmire … as are all the central banks of the world. The parade of walking dead has circled around them, and they will have to throw them some rotting meat to save their own souls. That’s about as good as this economy gets.

I think you can attribute the stock market’s bounce back from our January crash to this being the most extraordinary election year in our lifetime. When have we seen an anti-establishment candidates who are barely members of their own parties rise to such prominence? The establishment is desperate.

Anything and everything will be tried behind the scenes in both parties to keep Trump and Sanders from appearing correct about the economy and to make sure that, if the economy falls, it happens during their watch if they do get elected so that the establishment can say, “See, we were right. Now come back to your senses and vote with the establishment.”

So, I expect the summer to be a topsy-turvy ride as the parade marshals battle their own economies to keep the zombies moving through the election cycle … if they can. I have no idea of they will succeed, but it should be interesting.

The China Syndrome

An article last week in the politburo’s People’s Daily, which many think was written by China’s president, declared war on debt and the “fantasy” of perpetual stimulus. The article stated that bankruptcies need to be allowed to run their course from this point forward to weed out the bad debt and that the nation must endure hardship now, or the hardship will certainly be much worse in the near future. (A course the United States should have endured seven years ago, and we might have a real recovery.)

The article described debt as the “the original sin” and warned of a financial crisis if the government does not stop its knee-jerk stimulus every time markets fall. Remarkably, the Chinese seem to have become far smarter about capitalism than capitalists, stating, “It is neither possible nor necessary to force economic growing by levering up.”

That’s right. You cannot build true, enduring wealth over an ever-expanding chasm of debt as a foundation.

If this marks a pivot by the Chinese government, given the imperious tone of the anonymous article, it will set off an international chain reaction.

No one seems sure whether this article was a last hurrah by reformers within the government or a dire warning from the man at top that those within government had better start carrying out directives.

A day after the article was published, President Xi lashed out at “careerists and conspirators existing in our Party and undermining the Party’s governance.” He also denounced the resurgent property bubble and excesses in government. His outcry lends support to the idea that the article came from him or had his blessing.

Despite earlier efforts to curb China’s national housing bubble that created housing to nowhere, new housing starts in April rose 26% (yoy), and prices jumped as much as 63%. Meanwhile rot in China’s $7.7 trillion bond market is spreading like an ameba that has engulfed major Chinese ship builder Evergreen, whose containers are seen all over the world. Increasing bond troubles include the suspension of nine bonds issued by China Railways Materials, the first of China’s major socially owned enterprises to show signs of slippage into default.

Given this week’s article and the president’s subsequent rant, belief that government support may intervene in the next great Sino crash as it did last August may be faulty. Sounds like the president is ready to let the dead … die. Ambrose Evan-Pritchard believes this storm from the orient will gather by this coming fall … or sooner.

S&P 500 and Dow appear to have the zombies’ bite

On a lesser note first, both the S&P 500 and the Dow started kicking the dust again last week, going negative for the year … at least briefly. The old adage “sell in May” may prove to be the right dictum once again, as stocks typically perform poorly during the summer. January may prove to be predictive for the year, too, as declining January’s have tended to be.

Besides going briefly negative for the year, the S&P 500 staged one of its most dangerous flags (according to those who love charts). The dreaded “death cross” happened last week when the fifty-day moving average dropped below the 200-day moving average:

This move is called a “Death Cross” and for good reason. The last time it happened was in 2008, right before the entire market CRASHED: (Zero Hedge)

The time before that was right before the tech bubble burst near the turn of the millennium. The market appears ready for another fall off the cliff even if the Fed doesn’t stab it in the head with a rate increase.

Other signs that the zombie epocalypse lies just ahead

The Silicon Valley real estate bubble has finally burst, following the silicone tech bubble that burst when the FANG stocks began to implode late last year and early this. Naturally the collapse of the property bubble lags by a few months the numerous layoffs that occurred in high-tech companies like Yahoo.

The seemingly inexhaustible well of very high-end buyers has proven exhaustible after all. The peak is behind us, and that’s becoming clearer and clearer to builders and buyers. (Zero Hedge)

George Soros did well in seeing the crash into the Great Recession, and he’s now preparing for the next big crash.

Billionaire George Soros prepared last quarter for gloomy times, dialing back his U.S. stock investments by more than a third, betting against the equities while banking on gold…. The firm disclosed owning bearish options contracts on 2.1 million shares…. Soros, who built a $24 billion fortune through savvy market wagers, has warned of risks stemming from China, arguing its debt-fueled economy resembles the U.S. in 2007-08 at the onset of the global financial crisis…. [saying] a hard landing in the Asian nation was “practically unavoidable,” adding that such a slump would worsen global deflationary pressures, drag down stocks and boost U.S. government bonds…. (Bloomberg)

Soros’s former chief strategist, billionaire investor Stan Druckenmiller, is also bullish on gold. Earlier this month, Druckenmire made a massive change from being a roaring market bull to a growling bear:

“Three years ago on this stage I … drew a bullish intermediate conclusion as the weight of the evidence suggested the tidal wave of central bank money worldwide would still propel financial assets higher. I now feel the weight of the evidence has shifted the other way;higher valuations, three more years of unproductive corporate behavior, limits to further easing and excessive borrowing from the future suggest that the bull market is exhausting itself…. Volatility in global equity markets over the past year, which often precedes a major trend change, suggests that their risk/reward is negative….””

Druckenmire averaged annual returns of 30 percent from 1986 through 2010.

The SEC may be waking up just in time to crash an artificial rise in the stock market. It reported this month that it intends to go after major corporations that “inflate their sales results and employ customized metrics that stray too far from accounting rules.”

Since straying from GAAP seems to have become the only way companies can show any profit, this could kill that zombie practice, too,… if the SEC actually follows through.

Former President of the Federal Reserve Bank of Dallas, Richard Fisher, offered this sage (sarcasm alert) advice last week: “I would be prepared when they move—and I hope they move sometime in June—there’ll be a settling in of the market place. There will be a correction. Suck it up. Deal with it. That’s reality.” (Newsmax)

Nothing pops a delusion quite as quickly as a return to truth. I would be surprised if an SEC change resulted in any changes in June, as reining in this kind of activity will take months to start showing up in corporate reports; but it will be a reality check sometime this year if the SEC gets serious about it.

And last week a write-down of Puerto Rico’s $70 billion debt default became reality as Republicans and Democrats joined on a plan:

All of the political talking heads are supportive of the bill, with House Speaker Paul Ryan saying that “the stability of the territory is in danger…. Jack Lew [US Secretary of the Treasury] chimed in … telling bondholders that “the reality is if the economy of Puerto Rico doesn’t come back, the bondholders are not going to do well…. As we have repeated, the entire tone of the process is reminiscent of the 2008 financial crisis when Hank Paulson threatened Armageddon if nothing was done to bail the banks out. This time, Treasury Secretary Jack Lew was sending out letters warning that if no restructuring framework were to be set forth, a series of “cascading defaults” would be touched off. So, once again a path forward has been created that will simply wipe the slate clean.” (Zero Hedge)

We don’t know what will happen with a Brexit or whether a Grexit will raise its ugly head again or whether immigration tensions will spontaneously combust in Europe or the United State’s porous border has already allowed a terrorist invasion; but I think the frying pan will certainly be sizzling this summer to cook up the last of the market’s bully beef for the bears to feast upon.The increasingly scarce market bulls are dead cattle walking thanks to zombie economics. .