![Is the US stock market going to crash in 2017? [By Philip Timms [Public domain], via Wikimedia Commons]](http://thegreatrecession.info/blog/wp-content/uploads/CagedBear.jpg)

The Trump Rally pushed ahead relentlessly through a summer full of high omens and great disasters, all which it swatted off like flies. Even so, all was not perfect in the market as nerves began to jitter midsummer beneath the surface even among the most longtime bulls. Wall Street’s fear gauge (the CBOE Volatility Index) lifted its needle off its lower post to a nine-month high after President Trump’s comments about “fire and fury” if North Korea didn’t toe the line. (Mind you, the high wasn’t very far off the post because of how placid the previous nine months had been.)

As volatility stirred languidly over the threat of nuclear war, stock prices took a little spill with all major stock indices seeing their biggest one-day drop since May. The SPX fall amounted to a 1.4% drop in a day — nothing damaging. The Dow dropped about 1% in a day. But beneath the surface, the market is looking different and shakier.

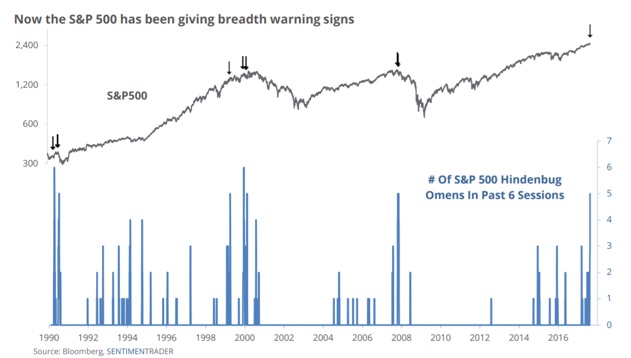

For example, trading narrowed to fewer players as more stocks in the Nasdaq 100 finally moved below their fifty-two week lows than moved above them. Likewise in the S&P. This phenomenon is known as the “Hindenburg omen,” and tends to precede major crashes.

It’s a serious signal that highlights times of decoupling within an index or an exchange. The S&P hasn’t suffered five signals so tightly clustered since 2007 and 2000…. This year the pattern has been popping up more often in all four indexes … 74 omens so far in 2017, second only to 78 recorded in November 2007…. That they are manifesting in several indexes and forming so frequently are good reasons to brace for weakness. (MarketWatch)

Long credit cycles like the current one always end with a crash. But first they deteriorate. The headline numbers remain positive while under the surface a growing list of sectors start to falter. It’s only when the latter reach a critical mass that market psychology turns dark. How far along is this process today? Pretty far, it seems, as some high-profile industries roll over: ‘Deep’ Subprime Car Loans Hit Crisis-Era Milestone…. Used Car Prices Crash To Lowest Level Since 2009 Amid Glut Of Off-Lease Supply…. Junk Bonds Slump…. The worst is yet to come for retail stocks, says former department store executive Jan Kniffen…. U.S. Stock Buybacks Are Plunging….“Perhaps over-leveraged U.S. companies have finally reached a limit on being able to borrow simply to support their own shares.” (–John Rubino, The Daily Coin)

The fact is that the market is breaking down beneath the shrinking number of Big Cap stocks and levitating averages. This has all set-up a severe downside shock within the coming weeks. As to the market’s weakening internals, consider that there are 2,800 stocks on the New York Stock Exchange (NYSE). Back in early 2013 when the bull market was still being super-charged with massive QE purchases by the Federal Reserve, 85% or 2,380 of them were above their 200-DMA. By contrast, currently only 1,050 of them (37.5%) are above that level, meaning that the bull is getting very tired. (–David Stockman, The Daily Reckoning)

Trading shifted this summer from the major players (often called the “smart money”) buying to smaller buyers trying to jump in, which is also the typical final scenario before a crash where the smart money escapes by finding chumps who fear missing some of the big rush that has been happening. And buybacks seem to be slumping as corporations hope for a new source of cash from Trump’s corporate tax breaks.

In spite of those underlying signs of stress, the market easily relaxed back into its former stupor, with the fear gauge quickly recalibrating, from that point on, to absorb threats and disasters with scarcely a blip as the new norm. The market now yawns at nuclear war, hurricanes and wildfires, having established a whole new threshold of incredulity or apathy, so the fear gauge stirs no more.

With the New York Stock Exchange eclipsed by the larger number of shares that now exchange hands inside “dark pools” — private stock markets housed inside some of Wall Street’s biggest casinos (banks) where the biggest players trade large blocks of stocks in secret during overnight hours — the average guy won’t see the next crash when it begins to happen. He’ll just awaken to find out it has happened … just like much of the nation woke one Monday to find out that northern California had gone up in flames over the weekend.

Bulls starting to sound bearish

While concern over these national catastrophes never came close to letting the bears out of their cages, it did change the dialogue at the top as if something was beginning to smell … well … a little dead under the covers. Perhaps these slight and temporary tremors in the market are all the warning we can expect in a market that is now almost entirely run by robots and inflated by central bank largesse.

While the bearish voices quoted above can be counted on to sound bearish, many of the big and normally bullish investors and advisors became more bearish in tone as summer rolled into fall. For the first time in years, Pimco expressed worries about top-heavy asset valuations, particularly in stocks and junk bonds, advising its clients in August to trim risk from their portfolios. Pimco argued that that the new central bank move toward reversing QE could leave equities high and dry as the long high tide of liquidity slowly ebbs. Pimco’s former CEO said much the same:

Bill Gross … perhaps the preimminent bond market analysts/ trader/ investor of the age… has gone on record as stating only just recently that the risks of equity ownership are as high as they were in ’08, and that at this point when buying weakness “instead of buying low and selling high, you’re buying high and crossing your fingers.” (Zero Hedge)

Goldman Sachs even took the rare position that the stock market had a 99% chance that it would not continue to rise in the near future, and places the likelihood of a bear market by year’ send at 67%, prompting them to ask “”should we be worried now?” The last two times Goldman’s bear market indicator was this high were right before the dot-com crash and right before the Great Recession. In fact, there has only been one time since 1960 when it has been this high without a bear market following within 2-3 months. Of course, everything is different under central-bank rigging, but some central banks are promising to start pulling the rug out from under the market in synchronous fashion, starting last month. (Though, as of the Fed’s own latest balance sheet shows, they have failed to deliver on their promise, cutting only half as much by the close of October as they said they would.)

Morgan Stanley’s former chief economist said at the start of fall that the combination of high valuations and rising interest rates is about to reck havoc in the market. He claimed the Fed’s commitment to normalization should have come much earlier, as the market now looks as frothy as it did just before the Great Recession.

Citi now calculates the odds of a major market correction before the end of the year at 45% likelihood. Even Well’s Fargo now predicts a market drop of up to 8% by year’s end.

Speaking of big banks, their stocks look particularly risky. Two years ago, Dick Bove was advising investors to buy major banks stocks aggressively. Now, he’s taken a strikingly bearish tone on the banks:

A highly-respected banking stock guru warns that financial storm clouds loom for Wall Street’s bull rally. The Vertical Group’s Richard Bove “warns that the overall market is just as dangerous as the late 1990s, and he cites momentum — not fundamentals — as what’s driving bank stocks to all-time highs,” CNBC.com explains. “If we don’t get some event in the economy or in politics or in somewhere that is going to create more loan volume and better margins for the banks, then yes, they would come crashing down,” Bove told CNBC. “I think that the risk in these stocks is very high at the present time,” he said. (NewsMax)

It’s a taxing wait for the market

These are all major institutions and people who are normally quite bullish. Some of the tonal change is because of concern about the Fed’s Great Unwind of QE, while much is because enthusiasm over Trump’s promised tax cuts has become muted among investors deciding to wait and see, having been burned by a long and futile battle on Obamacare. In fact, the market showed more interest in Fed Chair Yellen’s suggestion of a December interest-rate hike than in Trump’s release of a tax plan.

Retiring Republican Senator Bob Corker predicts the fighting over tax reform will make the attempt to rescind Obamacare look like a cakewalk, and he intends to lead the fight as one of the swing voters to make sure it is not a cakewalk now that he and Trump are political enemies.

The Dow took a 1% drop in the summer when Bannon was terminated so that anti-establishment resellers felt they were losing the battle and when the Republican government seemed deadlocked on all tax-related issues, which it still may be.

On the bright side, with Mitch McConnel’s Luther Strange losing his senate race and Bob Corker quitting, anti-establishment forces appear to be gaining a little power. That’s, at least, something. On the other hand, Trump has just chosen an establishment man to run the Fed, and Trump, who once ridiculed Janet Yellen for propping up Obama’s economy with low interest rates, said a few days ago,

I also met with Janet Yellen, who I like a lot. I really like her a lot.

President Trump’s new Federal Reserve chair, Jerome “Jay” Powell, “a low interest-rate kind of guy,” was obviously picked because he is Janet Yellen minus testicles, the grayest of gray go-along Fed go-fers, going about his life-long errand-boy duties in the thickets of financial lawyerdom like a bustling little rodent girdling the trunks of every living shrub on behalf of the asset-stripping business that is private equity…. Powell’s contribution to the discourse of finance was his famous utterance that the lack of inflation is “kind of a mystery….” Unless you consider that all the “money” pumped out of the Fed and the world’s other central banks flows through a hose to only two destinations: the bond and stock markets, where this hot-air-like “money” inflates zeppelin-sized bubbles that have no relation to on-the-ground economies where real people have to make things and trade things…. The “narrative” is firmest before it its falseness is proved by the turn of events, and there are an awful lot of events out there waiting to present, like debutantes dressing for a winter ball. The debt ceiling… North Korea… Mueller… Hillarygate….the state pension funds….That so many agree the USA has entered a permanent plateau of exquisite prosperity is a sure sign of its imminent implosion. What could go wrong? (–James Howard Kunstler)

Powell doesn’t sound like a man who sees a need for change in the current Fed programming, but he is the very best Trump could think of for carrying out his desire to make America great again.

Bulls still climbing to dizzying heights

While some of the leading bulls have started sounding like bears of late, the bulls still lead the bears by more than 4:1, and investors remain in love with technology almost as much as they were before the dot-com crash. ”Still, as Sir John Templeton famously said,

Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.

We are clearly in the euphoric stage where the market just cannot stop itself from rising. It’s been a year-long euphoria now as the Trump Rally, which stalled for some time midyear, found a second wind. It is now on track to soon become the greatest rally in 85 years. You have to go back to FDR and the recovery from the Great Depression to find anything greater. No euphoria there, given that is all based on tax cuts that have as much likelihood of failing as the Obamacare repeal had.

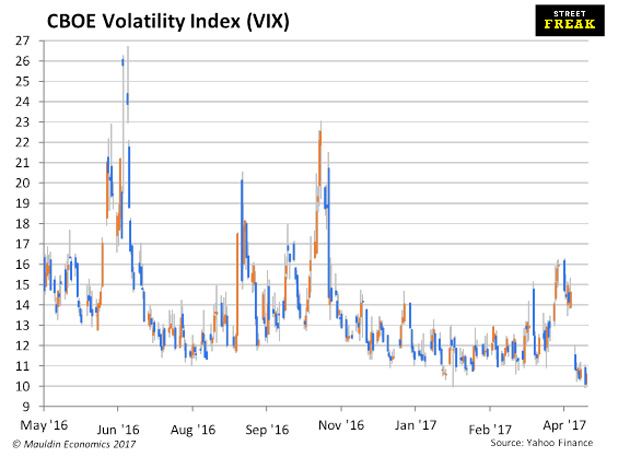

What is peculiarly interesting at present is the euphoria over volatility itself. Look at the following two graphs: (The first indicates what is happening in terms of market volatility. The second shows where people are betting volatility will go from here.)

The CBOE Volatility Index dove 8% last Friday to close the week just a hair’s breadth above its lowest volatility record ever! So, at a time when volatility in the stock market is essentially as low as it has ever gone, bets that volatility will go lower have risen astronomically. Yeah, that makes sense.

Essentially, hoards of investors are so certain that volatility is down for the count that they are betting it will practically cease to exist months from now. As Mauldin Economics has argued, we are now, among all our other bubbles, in a volatility bubble.

Such low volatility when the market is priced to its peak means market investors see no risk even at such a high top and even in an environment that has been literally plagued for months by external risks from hurricanes to wildfires to endless threats of nuclear annihilation by a lunatic. That’s because all investors know the market will stay up for as long as the Federal Reserve chooses to keep propping it up. Investors must not be taking the Fed’s threat of subtracting that support seriously, or they are choosing to stay in to the last crest of the last wave and then all hoping to be the first ones out before the wave crashes. Is that rational or irrational euphoria?

This market is not just notable for how long its low-volatility euphoria has gone on but also for how low the volume of trades have been. We are almost at a point of no volatility and no volume. That means nobody is selling stocks if they don’t get a higher price, but there aren’t many buying either. The few companies whose stocks are pushing the market up are trading less and less. That trend holds in both the US and Europe. European trading volume is its lowest in five years; and in the US, it is 22% below last year and still falling. That things are so calm in the middle of global nuclear threats, devastating hurricanes and wildfires and constant political chaos on the American scene and with such a do-nothing congress strikes me as surreal.

The Wall Street Journal concludes,

The collapse in trading volumes is closely tied to the recent fall in volatility, where measures of daily stock price movements have plumbed multiyear lows. When markets aren’t moving, there are typically fewer people scrambling to protect their portfolios against further losses or seizing an opportunity to buy things that look cheap.” (The Wall Street Journal)

What does it mean; where do we go from here?

Even the WSJ says it isn’t sure what this low-volatility/low-volume stasis means. I have to wonder if the market will reach such a lull in volatility that everyone just sits there, looking at each other, wondering who will be the first to move again. Is that finally the moment panic breaks in? Even the Journal wonders if the eery calm means investors have simply become so bullish they refuse to sell. Or is it that everyone is already in the market who wants in at current prices now that the Fed has stopped QE and is now even reversing it. Is the lull extreme narrowing happening because there is no longer excess new money in the market to invest but no one scared enough to drop their price and sell? Is there no money that wants in at current prices and under the current knowledge that money supply will now be deflating for the first time in years?

Is this the way the unwind of QE starts to suck money back out of the market … by reducing the number of interested traders to a thin trickle while the fewer number of interested players who do have money to invest keep bidding up prices? If you’re already in this hyper-inflated market, where earnings only look good on a per-share basis because companies keep spending a fortune buying back shares, then you may see no reason to sell; but, if you’ve been sitting on the side with a pocketful of cash, it may look awfully late in the game to jump in.

(Consider also that growth in earnings throughout the first half of 2017 was easy to show because it compared to the first half of 2016, where earnings were terrible. Now the climb in earnings has to steepen in order to show growth year on year.)

So what if the tax reform that everything seems to be depending on flops? Charles Gaparino warns,

If tax reform bellyflops the way ObamaCare repeal did, many smart analysts are coming to the conclusion that the market will turn sour. Without tax cuts, one Wall Street executive told me, “the markets will drop like a rock….” This is a significant change in investor attitudes…. As much as stock values represent economic and corporate fundamentals, they also represent raw emotion known as the “herd mentality.” And that mentality, according to the investors I speak to, has begun to shift in recent weeks…. The market mentality that once said anything is better for the markets than Hillary is now saying to the president and Congress: Deliver on those promised tax cuts or face the consequences. And they won’t be pretty. (The New York Post)

Evidence of how reactive the market will be if tax cuts are less than expected came a couple of weeks ago when the Russel 2000 fell the most it has since August on news that the Republicans’ proposed corporate cuts would be phased in over a period of years. That demonstrated that the Trump Rally is mostly about the tax cuts; they are fully priced in; so, if the tax cuts fail or even get dragged out over years, the market fails.

With savings way down, personal debt extremely high, corporate debt quite high, and central banks threatening to reduce liquidity, consumption will have no means of support if asset prices also fall; so, the whole broader consumer-based economy goes back down if the stock market fails. Of course, central banks will revert to more QE if that happens; but each round of QE has been less effective dollar-for-dollar.

And where have we arrived under complete Republican leadership in the midst of all this? As the Committee for a Responsible Federal Budget stated,

Republicans in Congress laid out two visions in two budgets for our fiscal future, and today, they choose the path of gimmicks, debt, and absolutely zero fiscal restraint over the one of responsibility and balance. While the original House budget balanced on paper and offered some real savings, the Senate’s version accepted today by the House fails to reach balance, enacts a pathetic $1 billion in spending cuts out of a possible $47 trillion, and allows for $1.5 trillion to be added to the national debt…. The GOP is now on-the-record as supporting trillions in new debt for the sake of tax cuts over tax reform…. “Tax cuts do not pay for themselves; they can create growth, but in the amount of tenths of percentage points, not whole percentage points. And they certainly cannot fill in trillions in lost revenue. Relying on growth projections that no independent forecaster says will happen isn’t the way to do tax reform. (TalkMarkets)

This is progress? The Republicans are proving month after wearying month they are incapable of doing everything they have sworn for years they would do if they were in power. They could complain as an obstructionist body about the other sides, but they have no solutions they can agree on. The Republican answer in the budget and tax plan that have just come out guarantees mountains of additional debt as far as the eye can see … with the perennial promise that cuts will eventually be made in some distant future by a congress that will not in any way be beholden to the wishes and slated demands of the present congress. (Always tax cuts now, spending cuts promised to be made by other people far down the road.)

If the program passes, however, it will shore up the stock market which has been banking entirely on that possibility; but at the cost of deeper economic structural problems to be solved (as always) by others later on. If it doesn’t pass, you do the math as to what that likely means for all the underlying weaknesses presented above when huge tax breaks are already baked into stock prices.

If you want to see whether or not tax cuts have EVER created sustained economic growth, read the last article linked above, but here is a chart from that article for a quick representation of the truth:

UPDATE: This Has Never Happened Before To The Nasdaq

(Two days after initial publication of the above article)

No 52-week high in the Nasdaq 100 has ever been accompanied by as few advancing stocks as today’s. Today’s action on the Nasdaq exchange is Exhibit A. On the one hand, the Nasdaq 100 (NDX) managed to rally – again – closing at a new all-time high – again. Despite the new high, however, the breadth on the Nasdaq read as follows (according to our vendor):

Nasdaq Advancing Issues: 840

Nasdaq Declining Issues: 2105… As a matter of fact … today saw the fewest advancing issues ever on a day when the NDX closed at a 52-week high. (Zero Hedge)