In the fall of 2015, the world descended into an economic apocalypse that will transform the globe into a single cashless society. This bold prediction is based on trends in nations all over the earth as shown in the article below.

As we enter 2016, we are only beginning to see this Epocalypse form through the fog of war. The war I’m talking about is the world war waged furiously by central banks against the Great Recession as the governments they supposedly serve fiddled while their capital burned.

The governments and banks of this world advanced rapidly toward forming cashless societies throughout 2015. The citizens of some countries are already embracing the move. In other countries, like the US, citizens fear the loss of autonomy that would come from giving governments and their designated central banks absolute monetary control.

The Epocalypse that I’ve been describing in this series will overcome that resistance during 2016 and 2017 as it wrecks economic havoc to such a degree that cash hold-outs will be ready for whatever holds the greatest promise of saving them from their collapsed monetary systems, fallen banks, deflated stocks and suffocating debt. One has only to think about how quickly and readily American citizens forfeited their constitutional civil liberties after 9/11 when George Bush and congress decreed that search warrants were not necessary if the government branded you a “terrorist.”

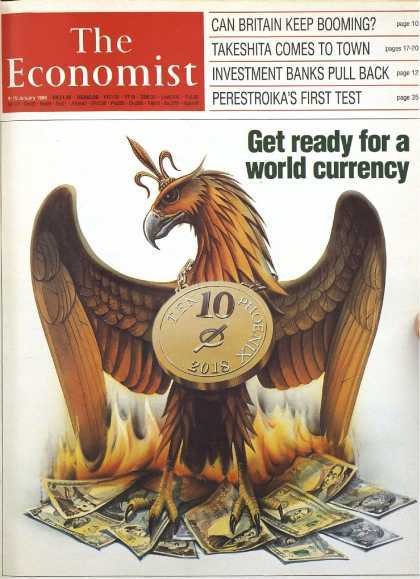

If this sounds like some wild conspiracy theory, consider the following: no less Sterling standard of global economics than The Economist predicted thirty years ago that by 2018 a global currency would rise like the phoenix out of the ashes of the world’s fiat currencies:

THIRTY years from now, Americans, Japanese, Europeans, and people in many other rich countries, and some relatively poor ones will probably be paying for their shopping with the same currency. Prices will be quoted not in dollars, yen or D-marks but in, let’s say, the phoenix. The phoenix will be favoured by companies and shoppers because it will be more convenient than today’s national currencies, which by then will seem a quaint cause of much disruption to economic life in the last twentieth century. At the beginning of 1988 this appears an outlandish prediction.

As we near their prescient date of 2018, The Economist’s prediction doesn’t appear even slightly outlandish. If it still seems outlandish to you, read on. You’ll see how the cashless movement gained huge momentum throughout the world in 2015 in the articles referenced below where the voices and actions of numerous economists and governments press for the formation of a global cashless society.

It may have been a long time coming, but it’s certainly not hard for anyone to see now that the world’s currencies are, indeed, crashing all around us as we near the coming of this seemingly messianic money that was predicted to resurrect from the ashes of the world’s fallen currencies.

The beast of the Epocalypse

The central banks are now clearly losing their battle against the Great Recession. Instead of saving the world, they have created a raging beast with many heads that are emerging all over the world — commodity price crashes, junk bond crashes, currency crashes, global stock market crashes, hedge fund crashes, bank crashes and national bankruptcies. All of these developed because of the greatest money creation and lowest interest rates in the history of the world.

That last extravagant phrase — “in the history of the world” — is the kind of expression usually said as an exaggeration; but this time, brazen as it sounds, we all know it is not an exaggeration at all. It’s a brave new world that can look a statement like that in the eye and not flinch because it knows it to be entirely accurate. Central banks have truly engaged in the greatest inflation of money supply ever known on a global scale… and the result is going to be the explosion of these many overinflated monetary systems followed by the need to create something new as their replacement.

The Epocalypse, as I call it, is not merely the second dip into the belly of the Great Recession; it is the death of money.

The collapse of national currencies is unfolding as you read this. It can be seen in Greece, Italy, Brazil, China, and Russia, to name the most obvious. China’s crash in the value of the yuan, compared to other currencies, appears intentional, as a way to boost trade by lowering the price of Chinese exports relative to other currencies; but it is not clear that it is intentional because its descent has been repeatedly jarring.

The devaluations of the yuan is likely to ignite a currency war between nations. China is certainly declaring a currency war with the US dollar by unpegging the yuan from the dollar while getting the yuan accepted by the International Monetary Fund as one of the IMF’s few global trade currencies, making it a direct competitor to the dollar for global dominance in the money marketplace.

China intends for its currency to challenge the petrodollar and, so, along with Russia has been (as reported here for a couple of years) divesting from US treasuries to reduce its holdings in dollars so that it is not damaged when the dollar collapses, which it will if it loses its petrodollar status as the world’s main trade currency.

The falling value of most currencies, however, is far from intentional. It is a result of the rising dollar, national economic weakness, slowing trade, and sometimes sanctions. The Russian ruble crashed to record lows this week.

Late last month, we took a look at Russia’s economy and concluded that although the country has proven to be remarkably resilient in the face of collapsing crude prices, the outlook is darkening. The ruble has fallen for three consecutive years and is now under immense pressure both from Western economic sanctions and from crude’s inexorable decline…. The ruble has collapsed to fresh record lows and on Thursday marked its steepest two-day decline in nine months. (“Russian Ruble Crashes To Record Lows In ‘Panic’: ‘Some Investors Are Selling At Any Price’”)

Panic selling of the Russian ruble coincides with major bank collapses unfolding this week in Italy. Michael Snyder of The Economic Collapse Blog writes,

The Italian financial meltdown that we have been waiting for has finally arrived…. Italian banking stocks continued their collapse for a fifth consecutive day on Wednesday, and nervous Italians are beginning to quietly pull large amounts of money out of the banks. In particular, Monte dei Paschi is a complete and utter basket case at this point. A staggering one-third of their loans are “non-performing”, and the stock price has fallen a staggering 57 percent since 2016 began. (“A Run on the Banks Begins in Italy as Italian Banking Stocks Collapse”)

One doesn’t have to look far back into the unfolding global economic collapse to recall people rapidly pulling money out of banks in Greece. Before that it was Cyprus. Brazil is facing similar problems. Soon it may be Puerto Rico as that government moves into bankruptcy.

The stock markets of eleven European nations have fully succumbed to becoming bear markets. China’s is a bear market. Russia’s is a bear market, and the US is within an easy day’s journey of becoming a bear market. It is now bobbing along on the price of crude oil. Probably the only thing holding the US market’s head above water is the flight of capital from everywhere else in the world.

Because the Epocalypse is a global economic collapse that is creating global currency wars and national currency collapses, it will beg for a global economic and monetary solution. That solution is already in the making all over the world. At the same time central banks have been battling the Great Recession, their many member banks and the governments they are supposed to serve have been waging a war on cash. The People’s Banks of China (PBOC) , for example, has been planning to make the yuan a cashless currency since 2014.

China charts course to become a cashless society

As the war on cash escalates, officials from The IMF to China are seeing the opportunity to control the world’s money through virtual (cash-less) currencies. Just as we warned most recently here, state wealth control is the goal and, as Bloomberg reports, The PBOC is targeting an early rollout of China’s own digital currency to “boost control of money” and none other than The IMF’s Christine Lagarde added that “virtual currencies are extremely beneficial.” (“War On Cash Escalates: China Readies Digital Currency”)

The war on cash is happening openly now in societies that have pushed economic stimulus as far as they can. This is why governments are no longer the obstacle that The Economist thought they would be. Proof that we are entering the Epocalypse that will pave the way for acceptance of a global cashless monetary system can be seen in the now-obvious failure of the zero-interest polices of central banks. When hitting the zero bound failed to lift economies that crashed in the Great Recession, some central banks moved to force negative interest rates on people who save their money in banks.

Charging people to keep their money in the bank is hard to do so long as cash is available, as people may just withdraw all of their money from those banks in the form of the national cash and squirrel the cash away. In order to penetrate the twilight zone of economics, central banks need to abolish cash to terminate this escape route. Then they can force savers to spend, thereby increasing the flow of money through the economy, by raising the cost of holding money in a bank account as high as it takes to get people to spend their money. No sense letting perfectly good money waste away in an expensive bank account.

Transitioning into a cashless society is the ultimate central planner’s dream as it gives central banks total control over money, and money is their proprietary product. Continuing from the article above,

Issuance of digital currency can help reduce costs, curb crimes and money laundry, facilitate transactions and boost central bank’s control on money supply and circulation, PBOC says in statement on website after concluding a seminar today. PBOC has asked its research team, which was set up in 2014, to study application scenarios for digital currency and strive for an early rollout…. It can reduce the traditional distribution of digital currency note issue, the high cost of circulation, improve convenience and transparency of economic transactions and reduce money laundering, tax evasion and other criminal acts to enhance the central bank’s money supply and currency in circulation control, better support economic and social development, the full realization of inclusive finance help. Future, digital currency issuance, circulation system also helps build our new financial infrastructure construction, further improve China’s payment system, improve payment and settlement efficiency, promote economic quality and efficiency upgrades.

What government wouldn’t want all of that as it seeks solutions to the death of its current currency? And what international bank wouldn’t want that?

“Virtual currencies and their underlying technologies can provide faster and cheaper financial services, and can become a powerful tool for deepening financial inclusion in the developing world,” IMF Managing Director Christine Lagarde said in a statement Wednesday to accompany the report.

“The challenge will be how to reap all these benefits and at the same time prevent illegal uses, such as money laundering, terror financing, fraud and even circumvention of capital controls.”

The drive to breach the national boundaries of money and establish a global cashless society has become a World War on cash with IMF backing to go digital and global.

Cashless Canada comes within view

Cashless Canada comes within view

One recent headline in the intensifying war against cash is “MasterCard is at war in Canada, and it’s not against who you’d expect.” The battle described is MasterCard’s war on cash in hopes of establishing a cashless society in Canada because she who owns the money owns the country:

In Canada, the biggest rival MasterCard Inc. is working to obliterate, according to its local president Brian Lang, isn’t Visa Inc., American Express Co., Interac Association or Bitcoin dealers. It’s cold, hard cash.

Lang states that Visa and Interac are working toward the same goal of establishing a cashless society … or, as he spins it, a “digitally enabled country.”

His expressed objections to cash, besides the fact that it is bulky and dirty, is that it leaves no trace of its movement. And that is the part where you may want to become concerned because that is the argument that has governments now moving toward becoming cashless societies. They want to know what you’ve done with your money, to have a better pulse of the economy and of the taxes you should be paying, but cash is anonymous. Government doesn’t like anonymous because anonymity can’t be controlled.

Call for cashless society being made in major publications around the globe

Predicted The Economist thirty years ago:

National economic boundaries are slowly dissolving. As the trend continues, the appeal of a currency union across at least the main industrial countries will seem irresistible to everybody except foreign-exchange traders and governments. In the phoenix zone, economic adjustment to shifts in relative prices would happen smoothly and automatically…. The absence of all currency risk would spur trade, investment and employment.

As national currencies now collapse, governments will find themselves scrambling for an answer to the Epocalypse — and answer they already want. Many want a currency that ends US hegemony, and President Obama seems more willing to end US hegemony than other presidents have been. All want a currency that smooths international trade. What The Economist thought some might find “outlandish” thirty years ago is now the clarion call of economists around the world and a move that has already begun in many nations:

The fact that people treat cash as the go-to safe asset when banks are teetering is heavy with historical irony…. Even as individuals have taken recent crises as reasons to stock up on banknotes, authorities would do well to consider the arguments for phasing out their use as another “barbarous relic….” Even a little physical currency can cause a lot of distortion to the economic system. (“The Financial Times Demands End Of Cash, Calls It A ‘Barbarous Relic.’”)

You see, major financial publications are now deeming cash as the criminal that causes “economic distortion.” Imagine that! Cash is the cause of economic distortion! No, it’s not central banks with their trillions of dollars of free cashless money that caused all the distortions that are now bringing an economic apocalypse down on our heads; its that much smaller part of the money spectrum that is made up of cold cash and paper bills that is causing all the troubles. It allows you too much economic freedom to operate outside of the banks and the government’s control over the economy.

You see, according to the Financial Times,

The existence of cash — a bearer instrument with a zero interest rate — limits central banks’ ability to stimulate a depressed economy.

I thought central banks loved zero interest rates! Hmm. Apparently not if they are not in direct control over that rate because you can take your cash out of their grubby hands.

The Financial Times also notes government has its reasons for wanting to create a cashless society:

Electronic money also permits innovations to reward law-abiding businesses. Value added tax, for example, could be automatically levied — and reimbursed — in real time on transactions between liable bank accounts. Countries that struggle with tax collection could go a long way in solving their problems by restricting the use of cash. Greece, in particular, could make lemonade out of lemons, using the current capital controls to push the country’s cash culture into new habits.

They want to control your spending habits and the things you do to mitigate your risks. It’s all about controlling and monitoring your behavior as a consumer. You see, those businesses that operate primarily in cash might be criminals. Naturally, criminals do love cash because they must have anonymity. The philosophy is rapidly gaining ground, as a result of that truth, that anyone preferring cash may be someone who needs anonymity for nefarious reasons. Then it progresses from “may be” to “likely is.”

Therefore, the article in this highly regarded financial publication advocates that governments start fining people who use cash, as if all of them are bad guys. The writer says that governments should make cash users “pay for the privilege of anonymity” so they will choose to work more with electronic money and, thus, “remainaffected by monetary policy.”

“Affected” is a nicer word than “manipulated” or “controlled.”

Banks really don’t like you having cash at all. Thus, a former Bank of England economist, Jim Leaviss, wrote a similar article in the London Telegraph in May of 2015, describing the move to becoming a cashless society as a panacea:

A proposed new law in Denmark could be the first step towards an economic revolution that sees physical currencies and normal bank accounts abolished and gives governments futuristic new tools to fight the cycle of “boom and bust”.

…Officially, the aim is to ease “administrative and financial burdens”, such as the cost of hiring a security service to send cash to the bank, and is part of a programme of reforms aimed at boosting growth – there is evidence that high cash usage in an economy acts as a drag.

But the move could be a key moment in the advent of “cashless societies”. And once all money exists only in bank accounts – monitored, or even directly controlled by the government – the authorities will be able to encourage us to spend more when the economy slows, or spend less when it is overheating.

Isn’t that nice? The aim is to encourage us to spend in ways that are helpful to all. You can become their little financial automaton. If you’re not taking out enough debt to keep the debt-based global economic system percolating, they can “encourage” you to do more, as the Financial Times writer suggested, by levying a fee on your holdings so that it is better to spend than to save. That way, when you get in trouble, you have no savings and have to take out a loan.

You cash hoarder! You are the reason the economy is dying, not the central banks! Their plan would have worked if you had not subverted it with your cashy behavior! The Epocalypse did not happen because it is impossible in the first place to create sustainable wealth out of debt; it happened because you are not participating as you should in the debt scheme! Once the old dinosaur economy dies and the blame is fixed squarely on you, becoming a cashless society will give the government means to “encourage” you to loosen your wallet a bit, spread your phoenix-like wings and spend more. Wasn’t that one of the founding roles of government — to cajole you toward the right economic behavior?

Leaviss’s article in The Telegraph recommends,

Having everyone’s account at a single, central institution allows the authorities to either encourage or discourage people to spend. To boost spending, the bank imposes a negative interest rate on the money in everyone’s account – in effect, a tax on saving.

You see, you don’t know what you’re doing with your money. Government know best. Leaviss goes on to say, as if this is a cheery-good thing,

Faced with seeing their money slowly confiscated, people are more likely to spend it on goods and services.

You see how much nicer that would be for all of us? If you don’t, you’re a cash hoarder, one of the criminal segment that destroys national economies by not participating enthusiastically in the government’s debt spending spree. So, one of the beauties of going cashless in the minds of some economists is that government will deal with you for not participating in the plans of these economists by confiscating some of your money for being so selfish. And that’s a good thing. (So we’re told.)

The most amazing thing to me is that people were openly writing this stuff in 2015 as if it was perfectly acceptable, and apparently it was because I didn’t hear much backlash.

On the other hand, what happens if the majority of people go on reckless spending sprees and start to overheat the economy, as the Chinese did in buying stocks? Well, becoming a cashless society neatly solves that problem, too:

What about the opposite situation – when the economy is overheating? The central bank or government will certainly drop any negative interest on credit balances, but it could go further and impose a tax on transactions.

So whenever you use the money in your account to buy something, you pay a small penalty. That makes people less inclined to spend and more inclined to save, so reducing economic activity.

Beautiful! You see how tidy that is? If you, the consumer, get a little too reckless in your disregard for risk, your favorite central banker can help rein you in by tagging a fee to each transaction to your purchases as a friendly disincentive to overspending. And, perhaps if the government doesn’t like certain vices, it can add a little extra tax of its own to those expenses.

Isn’t that fun? If consumers as an aggregate are getting carried away, the government can help save you from their mass recklessness. This is a special world.

The bottom line, apparently, is that our present tools used by central bankers to manipulate the economy (because we’re a capitalist society, not a centrally-planned economy, right?) are too thuggish:

Such an approach would be a far more effective way to damp an overheated economy than today’s blunt tool of a rise in the central bank’s official interest rate.

That kind of persuasion is caveman stuff. The author goes on to note that, if this all sounds rather fanciful (as in Orwellian?), Denmark is already doing it.

Get on the cashless society band wagon; set your money on fire

Your fellow citizens are headed that route anyway. Going back to the article about Canada, we read,

In the latest methods-of-payments survey, the Bank of Canada noted a 10-percentage-point decrease in the number of transactions paid by cash to 44 per cent in 2013 compared to 2009

You see, you’re already moving that direction on your own anyway. You can be sure that in the two years since that study, the number has become even less than 44% of Canadian transactions being by cash. It is not just governments that are on the cashless bandwagon because it gives them total control; it is citizens, too, (because we all find it handy so long as we’re not forced to go cashless). So, this trend toward total government and bankster control is a conveyor you are most likely already on … by choice.

As I reported in an earlier article, “Cashless Society Has Arrived, and It’s Global,” most Scandinavian countries have already gone this way or have made major strides in that direction. Those Scandinavians love a good socialist answer to everything. So, what you might have thought sounded like conspiracy at the beginning of this article is actually the norm in Scandinavian societies.

Get with the times! In case you thought (mistakenly) that going cashless might be hard on the poor who cannot afford smart phones and computers for making transactions in their petty businesses, au contraire. You have it all wrong. So, let this former central bank economist (we know how smart economists are) inform you:

Electronic money is an inclusive and convenient system, giving poor and rural sectors of an economy – where cash machines and bank branches may be few and far between and not all people have accounts – a tool for easy participation in the economy.

You see, cash is cumbersome to the poor. What if they cannot get to a cash machine to get some? (How have they ever managed to get it in the past without cash machines?) Going cashless alleviates their challenging need to find cash machines in rural areas. Of course they’ll need a smart phone or some kind of card scanner with a cell connection if they’re going to going to sell carrots from their roadside stand, but I’m sure the government can provide them with one if needed, as that is a basic right of every citizen “to be connected.” (Don’t know what they’ll do, though, if they’re stranded and suddenly need money to buy fuel off some farmer and they’re out of cell range.)

Those concerns miss the point, so please excuse me for interrupting with them. The important thing here is to recognize that this is an “inclusive” plan to help the poor who right now may be excluded from participating in the economy because of cash. (I knew the poor had a hard time getting cash, but I didn’t know it was because of the lack of cash machines in rural areas. Now I know. I always thought they just didn’t have any money, but it turns out it was just lack of cash machines.)

This might be the best insurance against economic collapse (Ad)

Your government is here to save you. Cash is an escape valve that puts you outside of their assistance. According to Leaviss, if you’re standing outside the electronic cash economy, you’re part of the “black economy.” You know, that hole in the eur-ozone that is full of death rays from outer space. You are one of the characters wearing the black hats. Why else would you choose to be so elusive and choose to avoid participating in the government’s control over the economy that is intended for the good of all society?

Do you see how the argument is shifting toward cash being evil and those who use it being part of the problem, instead of part of the solution? Get on the debt-credit wagon and join the race — the human race. Evolve, for crying out loud! You’re holding the economy back, you red-eyed fiend!

Bankers go bonkers over Bitcoin’s cashless solution

Yes, bankers once hated Bitcoin because they saw it as another thing that took people away from the currency they create and control. Central banks are owned by bankers, not by governments. The Federal Reserve merely has government appointees on its board and committees; but many of its board and committee positions are held by the bankers that own the central bank.

Even though Bitcoin is suddenly facing bankruptcy, its technology has something these top-level bankers want in order to create a centrally controlled cashless currency; but they cannot have Bitcoin out there doing it, or they will lose their monopoly on money. Bitcoin is to bankers what Uber is to taxi companies.

Another Federal Reserve conspiracy theory?

Read on:

Several years ago, the financial industry was abhorrently opposed to the introduction of bitcoin, a virtual currency that would revolutionize the way we conduct our banking business. Fearful of a massive professional upheaval, the financial cognoscenti steeled themselves in undermining this virtual currency.

Fast forward a few years, and ironically, Wall Street is now the largest proponent and investor in this space and the momentum continues to grow. (Newsmax)

Bankers now see how the technology that makes Bitcoin work is something they can use. They get it now … and you’re about to … especially once Bitcoin is out of the way as an alternative.

Goldman Sachs, Santander and BBVA have invested in start-ups that focus on harnessing this technology. Citigroup and JP Morgan have been conducting internal groups to assess how best to enter this area. And Barclays would like to implement this technology to offer consumer products that are less expensive than credit cards and direct money transfers.

My old friend (without the “r”) Bank of America is also chasing the technology now. And NASDAQ is pursuing it for processing equity transfers. No surprise that the US Federal Reserve and the Bank of England are in on the exploration, too. Suddenly everyone wanted Bitcoin, and just as suddenly it is going bankrupt.

With all of that (and additional articles for further reading below), how much do you want to bet that the answer arising out of the developing economic apocalypse will be a digital solution? It will also be a global solution to a global problem. After all, don’t global catastrophes need global answers? If the Epocalypse creates enough fear and suffering due to economic collapse, people will sell out their freedom for security.

So, stop being part of the problem! In the sixties people burned their bras. It’s time now to burn your bucks. Join the revolution! Break the buck! That day is nearly here. It will just take a solid economic collapse to soften you up into ready acceptance of the final solution.

The prediction of a final, global, economic system goes back a very long way:

He also forced everyone, small and great, rich and poor, free and slave, to receive a mark on his right hand or on his forehead, so that no one could buy or sell unless he had the mark…. (The Apocalypse of Jesus Christ 13:16 & 17 — commonly translated “The Book of Revelation” because “apocalypse” actually means “the uncovering” or “revelation,” though it is often thought of in terms of the global holocaust described in that ancient text.)

The phoenix zone would impose tight constraints on national governments. There would be no such thing, for instance, as a national monetary policy. The world phoenix supply would be fixed by a new central bank, descended perhaps from the IMF…. As the next century approaches, the natural forces that are pushing the world towards economic integration will offer governments a broad choice. They can go with the flow, or they can build barricades. Preparing the way for the phoenix will mean fewer pretended agreements on policy and more real ones…. The phoenix would probably start as a cocktail of national currencies, just as the Special Drawing Right is today. In time, though, its value against national currencies would cease to matter, because people would choose it for its convenience and the stability of its purchasing power…. Pencil in the phoenix for around 2018, and welcome it when it comes. (The Economist, January 9, 1988)

In case the move toward becoming a global cashless society still seems remote to you, look at how it gained popular momentum in the final quarter of last year as it has been implemented in some societies already:

Other articles from 2015 about the global cashless society movement

OCTOBER 22, 2015: Britain tries cashless society experiment

Shoppers will find their cash is worthless in one Manchester suburb as only cards will be accepted by stores on the high street.

As part of a social experiment, shops along fashionable Beech Road in Chorlton will only take payments on plastic.

…Mary Paul, of the Beech Road traders’ association, said: “Businesses can see the way things are going with more money being taken on cards across the board, so this is a very interesting glimpse into the future for all of us.”

…Some experts predict physical currency will cease to exist within 20 years.

…Recent research showed most Londoners would welcome a cash-free society as they’re so used to paying for everything with cards. (“Cashless High Street Ditches Notes And Coins”)

OCTOBER 31, 2015: Sweden pushes populace into cashless society

The Swedish government abetted by its fractional-reserve banking system is moving relentlessly toward a completely cashless economy.

Swedish banks have begun removing ATMs even in remote rural areas, and according to Credit Suisse the rule of thumb in Scandinavia is “If you have to pay in cash, something is wrong.”

…What is driving this movement to destroy cash is the desire to unleash the Swedish central bank to drive the interest rate down even further into negative territory. Currently, it stands at -0.35 percent, but the banks have not passed this along to their depositors, because depositors would simply withdraw their cash rather than leave it in banks and watch its amount shrink inexorably toward zero.

However, if cash were abolished and bank deposits were the only form of money, well then there would be no limit on negative interest rate policy. (“Sweden—Vanguard Of The Keynesian War On Cash”)

NOVEMBER 8, 2015: India and parts of Africa each intensify moves to become a cashless society

In many African countries, going cashless is not merely a matter of basic convenience … it is a matter of basic survival. Less than 30% of the population have bank accounts… But almost everyone has a mobile phone. Now, thanks to the massive surge in uptake of mobile communications as well as the huge numbers of unbanked citizens, Africa has become the perfect place for the world’s biggest social experiment with cashless living…. In Kenya the funds transferred by the biggest mobile money operator … account for more than 25% of the country’s GDP…. In India an even more ambitious project is under way: the Unique Identification Authority of India…. It will be the largest identity platform and biometric database in the world. There’s only one snag: according to its creators, the only way to make the system work effectively will be through the widespread adoption of electronic payment systems, side by side, as always, with biometric recognition systems. (“The War On Cash Is Advancing On All Fronts: ‘First They Came For The Pennies……’”)

NOVEMBER 23, 2015: Terrorism finally cited as good reason to switch to being a cashless society

Terrorists fund most of their activities in US dollars — anonymous cash dollars. If the US switched to becoming a cashless society, all dollars would have to be converted into electronic funds in order to avoid obsolescence. Then the activity of terrorists could be more easily tracked and frozen by government. So, the theory goes; but terrorists would find other avenues, such as gold. (“Leave Bitcoin Alone. Abolish Cash Instead.”)

DECEMBER 1, 2015: Switzerland’s negative interest rates prompt economists to encourage move to cashless society

The momentum keeps moving in economic debate toward creating cashless societies all around the globe so that central banks have more control over the economy. In this case it is because negative interest rates cannot fully create their objective of stimulating spending by taxing savings when people can just move their money out of banks in the form of cash. The debate also continues to focus on how easily taxes are avoided by cans deals. (“Do Negative Interest Rates Really Work? Look at Switzerland …”)

You can read more from David Haggith at his site The Great Recession, where this article first appeared.